Alto Investment from Amundi vs BlackRock Aladdin

Choosing the right investment management platform is a strategic decision that shapes your operating model, data quality, and long-term scalability. In this comparison of Alto Investment from Amundi vs BlackRock Aladdin, we break down how the two platforms differ in technology approach, target users, deployment models, and functional depth. Whether you’re evaluating a move away from legacy systems or benchmarking alternatives to Aladdin, this page gives you a clear and unbiased view to support a confident, well-informed decision. We’ll also look at why some managers shortlist Limina as a modern third alternative.

Note: Vendor information publicly available as of December, 2025 is the only source of information for writing this article. Sources include company websites, review sites (G2, Gartner, TrustRadius and Capterra) and industry publications.

Why clients opt for Limina

Limina increases automation across investment workflows, reducing manual tasks and operational risk. Clients gain a more efficient, scalable foundation from day one.

Limina is a fully independent technology provider with no competing investment products. Our platform and roadmap are driven solely by your needs and long-term success.

What clients are saying

By adopting Limina's scalable platform, Avanza has launched 33% additional funds without having to scale its investment operations team. They achieved:

- Decreased dependency on single individuals - by replacing spreadsheets

- Improved operational efficiency - by increased automation

Genesis moved to Limina and achieved the benefits of a cloud-native environment (keeping governance & oversight intact):

- Lower IT costs

- Simpler BCP processes

- More efficient operations

What makes Limina different?

Partnership that matters

With Limina, you are never just another client within a large global vendor’s portfolio.

- Direct access to buy-side specialists who understand your setup and challenges

- A collaborative approach that allows you to influence our product roadmap

- Support without slow escalation layers or rigid service tiers

- You are treated as a priority, not a small customer among thousands

Connect to anything

Limina provides genuine architectural freedom by allowing seamless connectivity across your ecosystem.

- Standard connections to leading data and service providers

- No-code tools so you can create and maintain integrations in minutes

- Straightforward connectivity to custodians, internal systems and data warehouses

- Freedom from vendor lock-in through transparent and client-controlled integrations

Modern UX, Everywhere

Limina provides a fast and intuitive user experience without the outdated interfaces found in many legacy systems.

- Full access through browser, tablet and a native mobile app

- Clear and efficient workflows that reduce errors and training time

- Designed for speed, with mobile approvals and real-time oversight

- No need for IT or vendor involvement for simple workflow adjustments

One system for all workflows

Limina brings the entire investment lifecycle together in one unified platform.

- All asset classes and workflows managed in a single, integrated system

- Built-in automation and controls that improve accuracy and reduce risk

- No hidden integration costs that often arise with fragmented solutions

- Rapid onboarding of new workflows and asset classes without disruption

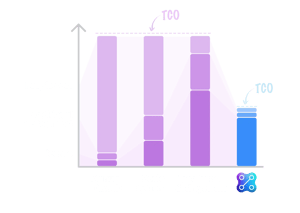

Efficient processes = Save money

See the next market leader in action

If you're looking to get ahead, and stay ahead, why not schedule a no obligation demo with us at a time to suit you?Choosing Between Alto and BlackRock Aladdin

Choosing between Alto Investment from Amundi Technology and BlackRock Aladdin is not simply a matter of comparing feature lists. These platforms represent two very different approaches to investment management technology and can have a far-reaching impact on your operating model, data flows and long-term agility. Alto is less widely known in the global market, yet it is often evaluated by firms seeking modular functionality backed by a major asset manager. However, its practical implementation experience can feel far more traditional than expected, with firms frequently reporting complex setup, limited integration flexibility and a steeper learning curve.

BlackRock Aladdin, by contrast, has become one of the most recognised platforms in the industry due to the strength of its risk analytics and its deep integration within large-scale institutions. Yet its breadth and maturity can also make it demanding to implement and maintain, particularly for firms that require rapid change or leaner operating environments. When weighing these options, you must consider not only functional scope but how each system aligns with your firm's size, governance structure, technology ambitions and appetite for operational overhead.

The following sections provide a detailed comparison to help you understand the practical differences between Alto Investment and BlackRock Aladdin and how each is likely to perform in the context of your current and future requirements, and if the Limina IMS could be a better choice for your business.

- 01 Technology Fit

- 02 User Experience

- 03 Operational Scope

- 04 Integration

- 05 Suitability

- 06 Summary

Understanding the Architectural Foundations of Alto Investment and BlackRock Aladdin

Alto Investment by Amundi Technology is a modern, modular platform, yet some client experiences highlight a more traditional architectural approach. Some firms observe that the system requires heavy tailoring before it supports their workflows effectively. This reliance on vendor configuration can slow progress during implementation and create longer-term dependency whenever changes are needed. The rigidity of the underlying data structures can limit adaptability, which is a challenge for organisations that expect responsive, self-configurable tools and wish to evolve their architecture without extensive intervention.

Aladdin, while powerful at scale, reflects decades of incremental development. Its layered architecture supports extensive risk analytics but also introduces complexity. The platform often operates with longer release cycles, structured governance and dependency chains that can make workflow changes or new integrations slow to introduce. Aladdin is therefore best suited to firms that can accommodate a more rigid, highly controlled technology environment.

Firms seeking faster change and a more contemporary architectural approach often compare these legacy platforms with modern alternatives such as Limina’s Investment Management System, which is built to support operational agility and clearer ownership of configuration.

Assessing Day-to-Day Usability and Adoption Across Your Teams

The user experience of Alto Investment reflects its operational depth but can feel complex for everyday use. There have been reports that navigating the system involves multi-step processes that slow down portfolio managers and increase dependency on training. The interface conveys a sense of capability but not always clarity, and teams often struggle to make quick adjustments without referring back to vendor documentation or support. This can impact adoption and reduce efficiency across both front and middle office teams.

Aladdin’s interface is similarly extensive. Although it provides access to highly advanced analytics, users frequently find it dense, fragmented and resource intensive to master. Separate views, configuration overlays and the system’s legacy design patterns can make familiar tasks take longer than expected. Adoption outside core user groups is often limited because the platform requires consistent, hands-on expertise.

By contrast, firms that prioritise intuitive workflows, cross-device access and rapid onboarding often gravitate towards more modern solutions. Limina Investment Management Solution demonstrates how a clean, efficient design can improve adoption across the entire organisation.

Comparing Functional Breadth and Real-World Implementability

Alto Investment and Aladdin both offer wide coverage across portfolio management, order management, compliance, reporting and risk. However, breadth alone does not guarantee effective use. Alto’s modules frequently require teams to engage in detailed configuration exercises before they become truly productive. While this can ultimately support customisation, it often extends implementation timelines and increases dependency on vendor consultants. The need for deep tailoring also introduces complexity when business requirements evolve, as even small changes can require reconfiguration rather than simple adjustments.

Aladdin presents the reverse challenge. Its breadth is highly mature, but the platform expects firms to work within predefined workflows. Customisation is possible but tends to be costly and slow, involving structured change processes and long validation cycles. Many firms find that once established, the operating model becomes difficult to adjust without significant planning.

Organisations seeking predictable, transparent and controlled change management often compare these experiences with modern approaches like the Limina implementation process, which focuses on clarity, speed and reduced operational disruption.

Evaluating Connectivity, Data Flows and Architectural Flexibility

Integration capability often becomes a deciding factor when comparing Alto and BlackRock Aladdin. Alto’s integration model typically requires substantial technical support, both during implementation and throughout the system’s lifecycle. Firms report that they find it challenging to connect Alto to internal tools, external data providers or administrators without vendor involvement. This results in longer project timelines and limited flexibility when expanding or modifying the architecture.

Aladdin provides strong internal connectivity but is more restrictive when integrating external systems, particularly specialised analytics tools or proprietary datasets. This limitation can create an over-reliance on the Aladdin ecosystem and limit architectural freedom. Firms that value an open model or wish to maintain autonomy over data flows may find this approach restrictive.

By contrast, organisations seeking transparent, client-controlled connectivity often explore newer platforms that are designed around openness from day one. The Limina Investment Management Solution is built to allow firms to connect to any counterparty, administrator or internal system without introducing unnecessary friction.

Understanding Which Types of Firms Alto and Aladdin Serve Best

Aladdin is typically selected by large asset managers and institutions that can support complex implementations, structured governance and continuous investment in system ownership. Its scale and analytical depth are valuable for organisations with established operational teams, although the platform often comes with a substantial enterprise-level pricing model. Licensing is generally bundled, and the total cost tends to rise as firms expand their user base, asset classes or module coverage. For firms seeking leaner operations or expecting frequent internal change, Aladdin can feel disproportionately heavy both operationally and financially.

Alto Investment from Amundi Technology is more frequently evaluated by firms seeking modular functionality supported by a prominent asset manager. However, while the licensing structure is modular, firms often find that implementation and configuration costs accumulate quickly due to the system’s heavy reliance on tailoring and vendor involvement. The need for extensive internal resources and vendor support can make the overall cost of ownership higher than initially expected. Organisations with limited operational capacity or those seeking faster, lower-friction evolution may therefore find Alto challenging in both practicality and budget impact.

As a result, many firms also consider options like Limina, which offer greater transparency around pricing alongside a modern, agile platform that reduces operational overhead.

Which Platform Fits Your Firm Best?

Choosing between Alto Investment from Amundi Technology and BlackRock Aladdin comes down to assessing your firm’s resources, appetite for complexity and long-term ambitions. Alto presents modularity and promises flexibility, but reports suggest that in practice, it requires heavy configuration, vendor involvement and strong internal technical capacity. That may make it better suited to firms with established operational teams prepared to manage complexity and customisation.

Aladdin offers mature analytics, comprehensive risk and compliance tools and a robust feature set. However, its enterprise scale and governance model typically involve broad licensing structures where costs increase as firms expand users, asset classes or functionality. For firms seeking leaner operations, frequent change or a lighter maintenance burden, Aladdin can feel both operationally heavy and expensive to maintain.

For organisations aiming for agility, transparency and a manageable cost of ownership, modern alternatives provide a compelling proposition. Solutions like Limina deliver the functional coverage necessary for investment management, combined with cleaner implementation, simpler usability and a clear pricing model.

For many firms evaluating Alto or Aladdin today, the real appeal lies in platforms that enable flexible growth rather than complex upkeep.