Order management

Limina's OMS makes it easy to trade and manage the full order lifecycle from idea to post-trade allocation.

Smooth order workflows, from start to finish

Efficient order raising

Regardless of your investment strategy, Limina IMS makes it easy to create orders:

- Quick order-entry

- Sophisticated rebalance capabilities (vs model, leader/follower, ad-hoc, duration impact and more)

- Order import

Automatic pre-trade compliance

Limina's powerful compliance framework is seamlessly embedded into the order workflows:

- Automatic pre-trade compliance checks on new and changed orders

- Ability to simulate compliance before save ("what if" checks)

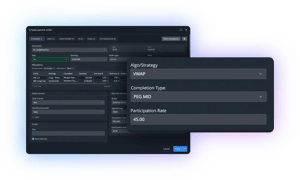

Route directly to brokers or execution platforms

- Direct to brokers (including algos)

- Via any number of EMSs (Execution Management Systems)

- Electronic fund trading for fund-of-funds

- Offline workflows for OTC scenarios

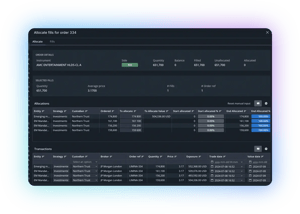

View & manage live orders

Full control of your working orders:

- Change working orders as needed - edit, withdraw, DFD and more (full FIX protocol support)

- Track order programs

- View estimated drift vs original target exposure % - especially useful for multi-day orders

Automated allocation process

Smooth post-trade processes:

- Automated Done for Day (DFD) processes

- Automated allocation handling - also for multi-portfolio scenarios (pro-rate with minimum allocation size and starvation logic)

- Charges (commissions, platform fees etc.) & SSIs auto-populated via rules

Integrated trade matching & TCA

Limina IMS includes out-of-the-box connectivity to the most popular post-trade solutions:

- Trade matching solutions (CTM & NYFIX Matching)

- Transaction Cost Analysis (TCA) platforms (ISS Liquidmetrix, Bloomberg TCA)

Institutional asset managers rely on Limina's OMS

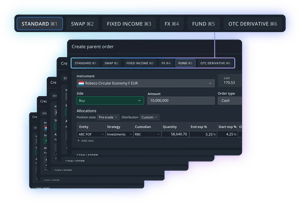

One OMS for all your assets

Trade equities, ETFs, funds, fixed income, FX, swaps and more from a unified trade blotter & entry screen in Limina IMS.

With our multi-asset platform, you can streamline your order management processes and replace manual routines with modern electronic trading workflows for all your asset classes.

Efficient multi-portfolio workflows

Trading for a large number of portfolios (e.g. separately managed accounts) is just as easy as for single portfolios, with Limina's model portfolio rebalancing capabilities and leader/follower style block orders.

Broker algos & complex order types supported

Trade the way you want with Limina's feature-rich OMS:- Broker algos & handling instructions

- Block orders (multiple portfolios)

- Order programs (multiple securities)

- Multi-day trading (GTC orders), with daily allocations for the executed part of orders

- Primary market workflows

- Cash vs quantity-based orders (e.g. for fund-of-fund trading)

- Derivative strategy orders

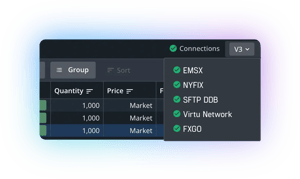

Connected out of the box

Limina's OMS offers plug & play connectivity to your brokers and the most popular EMS platforms and outsourced trading desks, all in real-time via FIX. Standard trading integrations include:

- Direct to 500+ brokers

- Bloomberg EMSX, TSOX & FXGO

- Virtu Triton

- 360T

- FXAll

- Fund trading platforms (SEB, Danske Bank etc.)

- and more...

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.