INVESTMENT COMPLIANCE

Cross-asset investment compliance software

In Limina’s Investment Management System, post- and pre-trade compliance is a native part of workflows. For example, when you rebalance whole portfolios, you can run simulated compliance checks and adjust portfolios iteratively if needed to ensure the program doesn’t breach any compliance rules. Limina supports various rule types, including advanced numerical limits, restrictions and cash ladder checks, and can even leverage custom classification data.

SOPHISTICATED COMPLIANCE ENGINE

Effortless portfolio compliance

Limina helps your team stay on top of compliance with minimal effort. Pre-trade checks run automatically during order raising, and includes smooth breach approval workflows. Should any unexpected effects from market movements, cash changes or partial order program execution occur, these are swiftly captured and alerted via post-trade checks that run automatically.

The seamless integration of portfolio compliance into Front Office workflows includes:

- Simulate investment compliance checks within the Portfolio Modelling Software, such as when calibrating inflows into multiple portfolios to a target model

- Receive a formal pre-trade check audit trail when saving orders. These audits are later available to produce compliance reports

- View compliance rule status (incl. how far from a breach you are) directly from the Trade Order Management System (OMS). You can manage breaches and request overrides without using the compliance application

A core principle behind embedding capabilities in workflows is our mission to help Asset Managers overcome fragmented workflows. I.e. to manage workflows within one solution without having to click between separate systems and suffer data discrepancies.

Pre- and post-trade compliance in one place

Compliance teams can mitigate risks and address challenges by having all positions and compliance rules in the same solution as the Portfolio Managers and operation teams use for their investment workflows.

One unified, cross-asset, trade compliance software helps investment managers improve governance. You avoid confusion and breaches when there is consistency between pre and post-trade checks, and all securities are in the same solution!

Why this is valuable to have, and difficult to solve well

The problem

Unlike in Limina - in many system landscapes, pre- and post-trade compliance technology are different solutions. Or asset classes reside in different systems. Historically, this has often been the result of pre-trade compliance being part of the order management solution which is often not capable of handling all post-trade rules, thus leading to the need to set up a separate post-trade compliance solution. To further complicate things, many firms have ended up with multiple asset class specific order management solutions, resulting in multiple pre-trade compliance engines.

Building one solution for all investment compliance needs is difficult since pre-trade involves simulations and assumptions, while post-trade involves reconciled data and monitoring financial market movements continuously.

The solution

Combined pre- and post-trade compliance software must be underpinned by a 3rd generation IBOR, capable of producing any portfolio view on the fly. With a modern IBOR, it’s not only possible to merge pre-trade and post-trade in the same solution but even blur the line between the two to what we call continuous compliance – checks that continuously run, taking orders, cash events and market movements into account intraday.

Solved well, a unified multi-asset pre- and post-trade solution removes tremendous complexities in system integrations/data synchronisation and disparate rule definitions and audit logs. It also greatly improves the efficiency and user experience for your whole team as they do not need to jump between different solutions, and can leverage data coming from a single source of truth.

Sophisticated pre- and post-trade compliance software

With 3rd generation IBOR technology at the core, our solution can quality control the data that underpin the asset management compliance. With that said, the actual engine is itself very capable:

We’ve designed Limina’s compliance engine to be lightning-fast with automated checks that run in the background, so you don't have to wait for compliance controls ever again!

Limina’s IMS can help lower operational risk in many ways. One way is through the ability to cater for your business's complex compliance rules. Examples include:

- Firm-level shareholder disclosure limits per region

- Maximum option premium paid during a fiscal year

- Maximum country-level and industry-level deviation from the benchmark (with custom country classifications)

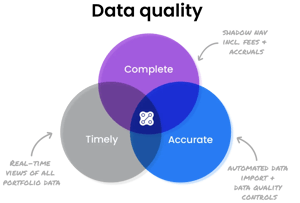

Data quality ensured in all investment compliance monitoring

To fully trust your investment compliance solution, you must know that all investment data that goes into the checks is accurate, complete and has arrived in time.

With Limina’s Investment Data Management Solution, you have a layer for configurable data quality controls. The data quality checks run automatically in the background, with a complete audit trail. The system will notify your operations team if anything unexpected happens, such as missing data from the custodian or significant market moves.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.