PORTFOLIO MANAGEMENT

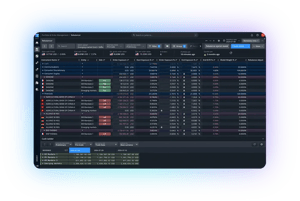

Portfolio tracking software & rebalancer

When managing your portfolios, efficiency and confidence in the numbers is crucial. Limina’s Portfolio Management Software (PMS) provides intuitive and streamlined workflows that help you get the job done quickly - regardless of asset class or style of investing.

SMOOTH WORKFLOWS FOR PORTFOLIO MANAGERS

“As a portfolio manager, I think the system is very user-friendly. It’s a modern, cloud-based system that is very adaptable to my needs in extracting information.”

Portfolio monitoring software

Limina offers multiple ways to track your portfolios in real-time:

- A dashboard with configurable visualisations of time-series (such as performance), breakdowns (e.g. sector or regional exposure), rankings (such as top contributing positions), and buckets (e.g. duration)

- A pivot table view. You can slice’n’dice on anything you want, including custom classifications. You can see multiple portfolios or funds in the same view and export the data to Excel with one click

- Notifications. You can set the system to notify you when something happens in your portfolio. You can decide what these events should be and trust that the system will catch them. Alerts can be set on anything from market movements through compliance to data issues identified

The investment monitoring platform updates all data in real-time, including fills, market data, and even cash records.

SEE THE DATA YOU NEED:

Drill-down or aggregated

Limina IMS can easily aggregate data when you need to. Our dashboard application provides a birds-eye view of your portfolio data across various analytics such as sector exposures vs. benchmark, duration buckets, firm-level shareholder disclosure limits and more. At the same time, you can drill down into exactly where a number is coming from.

In most systems, exposure per position is the most granular level. In Limina, you can follow exposures further to see exactly how the system calculated a specific number and what data went into it.

Rebalance & calibrate portfolios (Portfolio Modelling Software)

A versatile Investment Book of Records engine powers Limina’s rebalancer application. The IBOR engine can instantly build portfolio views (positions & cash) from underlying transactions and simulated orders. When you use the rebalancer, the system creates the entire view from scratch, not just adjusting weights imported from an accounting system. The result is a view that can exactly incorporate the impact of any change on exposures, durations, target weight, etc.

EXAMPLE USE CASES

A model portfolio in Limina can be a bespoke model, such as “Global equities” or “High Yield”. It can also be an exact index if you have index-tracking products.

When a model changes, Limina supports automatic rebalancing to it. Position calibration can be done for one or multiple portfolios at once. Models can be subscribed to as a %, such as if you have a fund that mixes “Global equities” at 60% and “High Yield” at 40%.

You can also exclude certain positions or aggregations before the rebalance is applied. For example, if the rebalancing should exclude a particular asset class or region.

Powered by a real-time Position & Cash Manager, Limina’s portfolio tracking and modelling software can instantly create any portfolio view you need. For example, if you calibrate to benchmark or model portfolio, Limina will show your simulated cash positions any day in the future (e.g. T+2) as well as position impact over time. This allows you to ensure you to mange varying settlement cycles (e.g. the North American T+1 shift), ensuring you are fully invested. without any cash overdrafts.

For clients with separate mandates or investment accounts that follow a leading portfolio, we offer convenient tools to replicate orders across the mandates at once (automatically).

Such replication allows for adjustment factors in case of specific restrictions in the mandates. As an example, you can target a % exposure against an issuer in the leading portfolio and automatically raise orders in the mandate portfolios.

You can even take into account if, e.g. a mandate holds an ADR, whereas the leading portfolio holds the actual stock.

- Quick order entry with quantity and % calculators, incl. multi-entity allocation

- Program trading (incl. import list from external systems)

- Option/future strategies

- Add/unwind directly from portfolio views (e.g. “sell all MSFT across all portfolios”)

Look-through

Limina's PMS allows you to get a view of your true underlying exposures with look-through capabilities for:

- Funds, such as mutual funds and exchange-traded funds (ETFs)

- Indices

- Derivatives, such as futures, options and structured products

The look-through model in Limina is recursive, which means that if you hold a Fund that, in turn, contains an index future, we’ll break apart both levels and show the constituent-level breakdown of the underlying securities. For example: stocks of the index future that is an underlying to your fund holding. The look-through lets you get true exposure across sectors, countries, individual companies and more.

Benchmarks

With Limina’s portfolio monitoring solution, you can see your existing portfolio and including simulated changes - all compared to the benchmark! You can see both in the same view regardless of asset class (fixed income, equities, derivatives, etc.) or grouping (sector, region, etc.).

We want you to be able to see all information, how and when you need it, so you can focus on investment decisions instead of spending time managing spreadsheets to make up for shortcomings in the portfolio modelling tools.

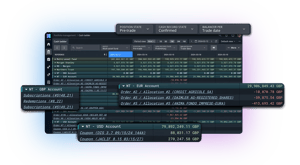

Forward-looking cash ladder

Limina’s portfolio tracking tools include a forward-looking cash ladder with several key capabilities:

- Detailed position states to see or remove impact from orders depending on their status (e.g., pre-trade, working, executed, or allocated), with cash impact determined by order limit prices or market quotes

- The projected cash impact of, e.g. coupons and dividend payments before ex-date. Even when you simulate a trade, these implicit cashflows are adjusted

- Ability to include preliminary cash records such as future management fee payments

- Cash can be modelled on portfolio or strategy level and as real cash accounts or synthetic

The cash ladder is fully integrated with order-raising workflows, such as rebalancing and single order entry, so you can see detailed cash impact prior to raising orders. Once you’ve created the orders, they move to the next step in their lifecycle: the Trade Order Management System.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.