Investment operations software

The team at Limina has held roles such as Head of Operations and Operations Manager. We appreciate the precision of your team members' daily tasks and processes. This is why Limina's Platform is designed for your investment operations team to ensure accurate portfolio data at all times.

We believe an investment operations system should enable an exception-based approach. This means the system should handle issue identification, notifying your investment management operations when something requires attention. Once an issue (or exception) is identified, you have more time to resolve it since the system manages the daily controls.

Investment operations technology: Trade matching & settlement

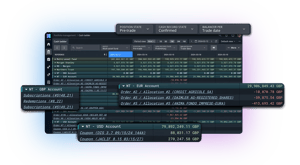

Limina's operational technology for asset management supports the post-trade lifecycle with highly automated processes for trade affirmation, matching and settlement:

- Settlement instructions are populated automatically on allocated transactions via a configurable rule framework

- Out-of-the-box connectivity to custodians and matching providers (e.g. Northern Trust IOO) allows you to make fast changes

As much as possible, we want to help you increase operational efficiency, and an essential cornerstone of that is automated data management. This automation includes populating fields according to set rules, such as allocations.

Cash management for investment operations

Thanks to our Position and Cash Management capabilities, the system can reflect all cash events, including:

- FX flows

- Fund expenses

- Interest income

- Transfers

The Capital Activity & Expenses application can accrue expenses so that you can accurately reflect the NAV. You can automate the booking of these flows via our configurable import/export app.

Leveraging our live-extract Investment Book of Record, Limina’s cash ladder includes historical and forward-looking cash views. The cash ladder has sophisticated controls to include data from the desired perspective – settle date vs. trade date. Finally, it has options as to what order lifecycle state to show and even the possibility of including forecasted dividend payments and coupons.

Corporate actions & position lifecycle

Limina's Investment Operations Software allows you to take an exception-based approach to managing corporate actions and position lifecycle events. Processing of corporate actions (dividends, splits, etc.) and position lifecycle events (coupons, bond redemptions, swap financing, derivatives expiries, etc.) is all handled automatically by the system. Of course, you can approve, amend or override the results.

For contractual information such as expiries and resets, such information is taken directly from the security master. For other ad-hoc events, such as corporate actions, the data can be imported automatically from custodian or market data providers.

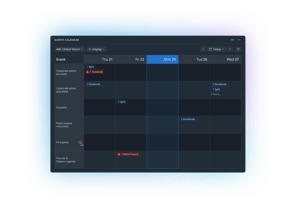

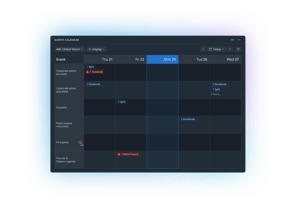

The Events Calendar gives an overview of upcoming events, ensuring portfolio managers and the operations team have a clear view of events affecting the portfolio.

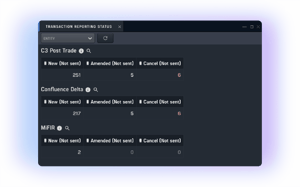

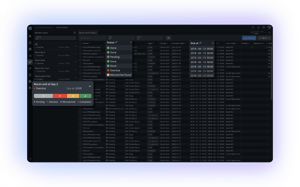

Reconciliation

As Limina is the source of truth for most of our clients, the data within it needs to be in sync with external systems and solution providers. Limina includes a powerful and flexible reconciliation application designed to fit into the daily routines of asset management operations. The recon application supports reconciliation tasks with due times that can run automatically. Notifications and dashboard widgets automatically communicate the status of the daily reconciliation, providing the whole firm additional oversight.

Shadow NAV

Limina's Investment Operations Platform also includes shadow accounting functionality, consolidating more capabilities. The Shadow NAV functionality lets you run independent controls of the NAV your fund administrator produces, including NAV per share for share classes in different jurisdictions such as UCITS.

The NAV manager can calculate GIPS-compliant P&L and include management fees. For FX-hedged share classes, hedging is possible on a share-class basis.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.