Securities Master Data Management: Building the Best Framework

This article describes what capabilities to expect from the best security masters, also called instrument masters. We discuss two kinds of such systems: integrated into another system (such as Investment Software Systems) or a standalone system.

For total transparency: Limina has a sophisticated security master, part of our investment data management software. The solution is integrated into front-office capabilities such as our Order Management System for trading and Investment Monitoring Platform.

What is a Securities Master?

A security master is a data set of financial securities such as stocks, bonds, derivatives, mutual funds, FX, etc. The inventory includes benchmarks and indices for performance attribution and exposure tracking. Indices can also function as model portfolios for passive fund strategies. Other types of utility instruments might exist, such as FX forward quotes for different tenors.

The goal of using software like this is to achieve the highest possible data quality: complete, timely and accurate data. I.e. to have instrument information you can trust in your investment decision workflows and portfolio risk management software.

The Security Master Data Model

The security master data model will differ between asset classes. Listed instrument types will have information about exchanges and exchange codes. Bonds and Interest Rate Swaps will have payment leg information such as frequency and day count convention.

Types of Security Master Reference Data

A fundamental requirement of a security master is that it can capture all data related to financial instruments. This means financial data that is directly relevant on the actual instruments themselves, including:

- Identifiers (Ticker, OpenFIGI, ISIN)

- Terms and conditions (day count conventions, settlement days)

- Classifications (credit ratings, industry and sector, ESG data)

- Market data (pricing data, valuations)

- Cash flows (coupons, principals)

The best security masters will be broader data mastering solutions and also include information that is adjacent to the instruments, such as:

- Holiday calendars, including blended calendars for e.g. mutual funds for example

- Corporate actions, including elective

- Issuers, including issuer hierarchies (corporate groups)

- External analytics (exposures, sensitivities)

Governance Processes and Automation

To achieve world-class data quality, you need a system that can automate checks for you. The system should also audit any change. For example, you should be able to receive a report daily with all changes made. Another setting that should be available is 4-eye approval, so your middle office operations team can approve changes that, for example, a data vendor has made.

Connect Multiple Data Vendors

Connectivity to data sources such as security master data should be a standard feature. As should automated download of data and re-download on a configurable cadence.

It should be possible to blend multiple sources for different asset classes or, in some cases, even combine multiple data sources for the same instrument. An adjacent feature is being able to configure price hierarchies, such as “use last if within the spread, otherwise use mid” type of rules.

Data download (and re-downloaded) should either be absorbed directly or staged for internal review and approval before it takes effect, – whichever fits your governance process. It’s essential that you have control of how the data looks in your systems, even if automation helps do 99.9% of the work.

Achieve Investment Data Governance with Data Quality Controls

You can reduce the risk of manual data mistakes and increase operational efficiency with embedded data quality controls. The best systems enable you to set up rules to validate anything from instruments to prices automatically. The system will flag any outliers and flag them for your data operations to review.

Additional Security Master Features

There are two more capabilities that the best security master systems require:

- Ability to extend security master data models. You might have instrument-level data unique to your style of investing. Examples could include bespoke ratings or classifications. Any system you choose must be able to support these custom data sets.

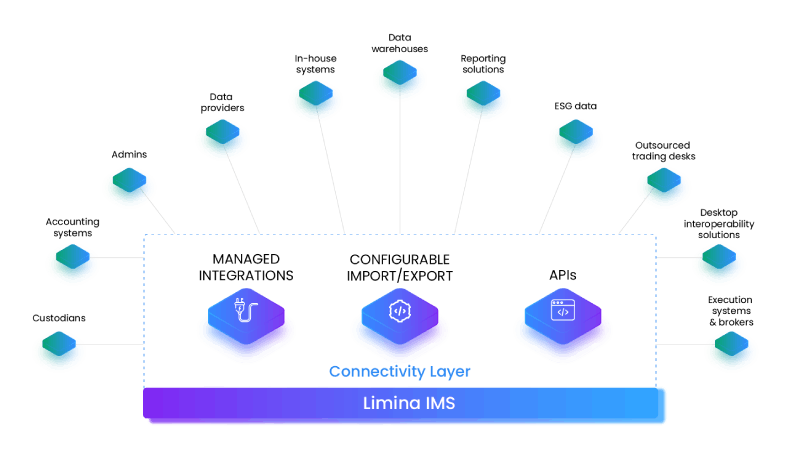

- Outgoing connectivity. The best data inventory is worth nothing if consuming systems can’t get access to data in simple ways. Exposing data through multiple means, such as via a user-configurable import and export application or APIs, is vital.

Standalone vs Integrated Security Master

Should the Security Master (also known as secmaster) be integrated into a Front to Middle Office system or be standalone? At Limina, we firmly believe it should be an integrated part of a broader solution.

Having it seamlessly integrated not only saves cost by having fewer systems, but it also gives the power of the security master to other stakeholders in real time. Essentially, an integrated solution helps you overcome fragmented workflows.

For example, an update to an instrument is natively propagated to all front-office users immediately. A change to an instrument can affect the live portfolio views without necessarily affecting historical NAV (unless you want it to). Another great example is compliance checks; assume you use bespoke classifications or ESG-data parameters in compliance rules. Such rules are natively supported if compliance and the security master are integrated parts of the same system.

To simplify things, a flexible data platform at the heart of your investment systems enables you to scale with superior operational risk management in the most cost-efficient way possible.