6 Best Mutual Fund Management Software Solutions Compared

Choosing mutual fund management software shouldn't be this hard.

Yet here you are, comparing platforms that all claim to be "comprehensive," "automated," and "cloud-native." Every vendor promises to transform your operations. Every demo looks impressive. But which one actually delivers?

The truth is, subscription fees often represent just one-third of total system costs. The rest hides in customisations, integrations, and manual workarounds; something that becomes evident after you’ve purchased the software.

We've analysed 6 leading mutual fund management platforms. Read on to know what these systems actually do when deployed.

Quick comparison: Mutual fund management software at a glance

What actually matters in mutual fund management software

Before diving into specific platforms, let's establish the criteria that separate great systems from expensive spreadsheet replacements:

Exception-based workflows

- The system handles routine tasks—trade bookings, rebalancing, corporate actions—and alerts you when something unusual happens. Think of it like a car that monitors oil levels and notifies you when low, instead of requiring manual checks.

Investment Book of Record (IBOR)

- A robust IBOR generates portfolio views for any use case. Simulated positions for the front office. NAV positions for middle office. Settled cash for operations. All from one data source.

User-configurable integrations

- Adding a new custodian or data source shouldn't require a five-figure consulting project or waiting 6 months for the vendor to have the time. Modern platforms let your team configure integrations themselves.

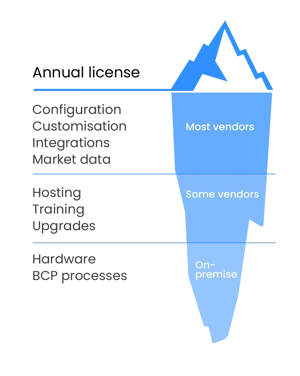

True total cost of ownership

- Beyond license fees, factor in customisation costs, integration expenses, IT overhead, manual workarounds, and the hidden cost of inefficient workflows.

Operating model: All-in-one vs best-of-breed

Your first decision isn't which vendor; it's which approach:

- All-in-one systems handle everything from order management to accounting in one platform. This simplifies connectivity, enables automation across entire workflows, and reduces integration complexity. The trade-off? You might sacrifice some specialised functionality.

- Best-of-breed means choosing specialised software for each function, one system for trading, another for portfolio management, another for compliance. You get deep functionality in each area, but workflows spanning multiple systems become inefficient.

Most firms land somewhere in between, with hybrid models that balance integration simplicity with functional depth.

1. Limina: Built for workflow efficiency

What it does: Limina is a cloud-native platform offering front-to-NAV functionality with a focus on exception-based workflows. The standout feature is their user-configurable import/export tool—your team can build integrations in minutes without IT involvement.

Details that matter:

- Clients report cutting operational workflows by up to 50%

- Portfolio managers spend an average of 15 minutes daily in the system

- Updates every 3 weeks with new features

Asset class coverage: Comprehensive support for equities, bonds, funds, FX, derivatives (futures, options, swaps), alternatives, and cash. The platform handles everything from common stocks to complex derivatives in one system.

Total cost reality: Transparent pricing model with no hidden customisation fees. No charge for initial setup, maintenance customisations, hosting, training, or upgrades. Integration costs are lower due to straightforward self-service tools.

Best for: Mid-sized fund managers, asset owners, SMA managers and hedge funds ($100M-$30B AUM) who want sophisticated functionality without enterprise complexity.

2. BlackRock Aladdin: The institutional standard

What it does: Aladdin combines portfolio management, trading, and risk analytics in a comprehensive platform. It's particularly strong in risk management, with advanced stress testing and scenario analysis capabilities.

Details that matter:

- Used by some of the world's largest asset managers

- Handles massive scale with institutional-grade infrastructure

- Extensive ecosystem of integrated Tier1 partners

Asset class coverage: Comprehensive coverage across all traditional asset classes. Expanded to alternative assets through the acquisition of eFront in 2019.

Best for: Large institutional investors with complex portfolios and dedicated IT resources.

3. SimCorp One (rebranded from SimCorp Dimension): The customisation powerhouse

What it does: SimCorp offers extensive functionality across front, middle, and back office with deep customisation capabilities. The platform is known for handling complex workflows and diverse asset classes.

Details that matter:

- Highly configurable to match specific workflows

- Strong presence among large European asset owners

- Comprehensive regulatory reporting capabilities

Asset class coverage: Extensive support for all asset classes with particular strength in derivatives and structured products.

Best for: Large firms with complex, unique workflows and the resources for extensive customisation.

4. Charles River IMS: Trading and compliance focus

What it does: Charles River excels in trading and compliance workflows, often used as part of a best-of-breed approach. Strong order management and pre-trade compliance capabilities.

Details that matter:

- Robust compliance engine handling complex regulatory requirements and internal rules

- Deep trading functionality across multiple asset classes, predominantly listed

- Part of State Street's broader ecosystem, including State Street Alpha

Asset class coverage: Good coverage of traditional asset classes with strong support for equities and fixed income.

Best for: Large asset managers and wealth managers ($50bn+) prioritising trading and compliance, especially those using other State Street services.

5. Addepar: Reporting and transparency specialist

What it does: Addepar focuses on data aggregation and reporting, providing clear, customisable reports for clients and internal use. Strong visualisation and client portal capabilities.

Details that matter:

- Excellent reporting flexibility

- Strong client communication tools

- User-friendly interface

Asset class coverage: Good support for traditional assets and alternatives, with particular strength in handling complex ownership structures.

Best for: Wealth managers and family offices prioritising client reporting and transparency.

6. SS&C Eze: Simplified trading operations

What it does: Eze provides order management and trading capabilities with a focus on simplicity and ease of use. Strong in basic trading workflows and execution.

Details that matter:

- Quick implementation for basic functionality

- Good broker connectivity

- Reliable for straightforward trading needs

Asset class coverage: Primarily focused on equities and listed derivatives with basic fixed income support.

Best for: Smaller firms with straightforward trading needs transitioning from manual processes.

Making your decision: Key considerations

Start with your operating model

Decide where on the scale from all-in-one simplicity to best-of-breed you prefer to land. This fundamental choice will narrow your options significantly and simplify the choice. However, pick a range, e.g. “all-on-one or close to it”, instead of an exact spot, otherwise you risk excluding too many vendors already at this stage.

Calculate true total cost

Remember: license fees are often just one-third of total costs. Factor in:

- Implementation and customisation

- Integration expenses

- Ongoing support & change management

- Upgrades and IT (N/A for SaaS/cloud)

- Hidden costs of manual workarounds

Evaluate workflow efficiency

The best system is the one your team will actually use less, because it get the job done fast. Look for:

- Exception-based automation

- Intuitive interfaces

- Self-service capabilities

- Minimal screen-jumping

Consider your growth trajectory

Your needs in 3-5 years might differ significantly from today. Ensure your platform can handle:

- New asset classes

- Increased AUM and transaction volumes

- Regulatory changes

- Team expansion

- without an exploding cost structure.

Test with your actual workflows

Don't trust the demo. Test platforms with your specific use cases:

- Your typical rebalancing scenario or order-raising workflow

- Your compliance requirements, including when a rule changes

- Your reporting needs, including setup of new reports

- Your integration requirements, including adding/changing connectivity

- review what happens when things change, not just how it runs on a normal day that looks like today.

The bottom line

The "best" mutual fund management software depends entirely on your firm's specific needs, resources, and growth plans.

For investment managers seeking modern architecture and efficiency, cloud-native platforms like Limina offer compelling value with transparent costs and self-service capabilities.

For huge institutions with complex needs, enterprise platforms like Aladdin or SimCorp provide comprehensive functionality at scale.

For firms with specific priorities—trading, reporting, or compliance—specialised solutions from Charles River, Addepar, or Eze might fit better as part of a best-of-breed approach.

The key is matching platform capabilities to your actual needs, not the needs the vendor thinks you have.

Ready to modernise your mutual fund operations?

For more information about modern mutual fund management software reach out to us: sales@limina.com

This piece is written based on publicly available information and documented capabilities as of 2025.