Best Investment Management Software & Tools: How to Choose the Right One for Your Business

How to identify the best Investment Management System for your needs

If you’ve searched for the best investment management system (IMS) or best investment portfolio management tools, you’ve probably noticed that every provider promises “the most advanced” platform. The reality? Best depends on your firm’s size, strategy, and workflow.

Whether you’re an asset manager, hedge fund, or family office, the goal is the same: find a platform that saves time, reduces risk and supports smarter decision-making. Let’s explore the features that matter most.

Key features that define the best Investment Manager Software

The ideal investment manager software doesn’t just tick boxes; it should solve real operational pain points. These are the features that separate the good from the great:

Front-to-NAV integration

Bringing front, middle, and back-office functions into one platform removes data silos and integration delays. This ensures everyone works from a single, consistent source of truth.

Pro tip: Ask if the system truly covers front-to-NAV, or if you’ll need extra tools for compliance, performance, or risk. For more detail, see our Portfolio Management Software (PMS) guide.

Real-time IBOR is essential in the best Investment Portfolio Management Software

Markets move fast, and yesterday’s portfolio view might already be outdated. An Investment Book of Record (IBOR) ensures real-time position data across trade, settlement, and projected states.

Why it matters: Decisions based on stale data increase operational and market risk.

Automation in Investment Manager Software: Time savings that matter

Automation should go beyond digitising tasks; it should remove them entirely. Exception-based workflows only flag issues that need attention, freeing teams from repetitive “all clear” checks.

Learn more about automated portfolio management and how automation is reshaping investment operations. For Limina-specific functionality, see our Fund Management Software overview.

Why the best Investment Management System should be scalable and connected

Your platform should connect to custodians, market data vendors, and internal systems without weeks of vendor intervention. Self-service integration is a huge time-saver.

Cloud-native systems also improve resilience and agility. Explore Gartner’s cloud investment management trends for a broader industry perspective.

Aligning your business needs with the best Investment Management Software

Choosing the right platform isn’t about picking the one with the longest feature list. It’s about matching capabilities to your businesses current needs and future plans:

| If you need... | Look for... |

| Multi-asset, multi-currency operations | Flexible asset class coverage |

| Faster onboarding for new hires | Intuitive, minimal-training interfaces |

| Less manual reconciliation | Exception-based automation |

| Regulatory peace of mind | Rule-based pre- and post-trade compliance – see SEC investment adviser compliance requirements |

| Expansion-ready operations | Modular, scalable architecture |

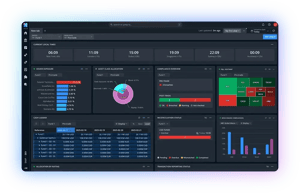

A real-world example of a modern Investment Management Platform

The Limina IMS is an example of a platform that aligns with these principles, combining front-to-NAV coverage, real-time IBOR, automation, and fast integrations into one system. While it’s not the only option available, it illustrates how a modern investment management system can reduce complexity and improve efficiency without overhauling your entire tech stack.

Common mistakes when selecting Investment Portfolio Management Tools

- Choosing based on a flashy demo without mapping features to workflows

- Ignoring future scalability, leading to costly migrations later

- Overcomplicating the tech stack with too many disconnected tools.

For more on avoiding selection errors, see Forbes’ guide to choosing financial software.

FAQs about the best Investment Management Systems & tools

Conclusion

The best investment management software isn’t the one with the most features—it’s the one that fits your workflow, adapts to your growth, and gives you reliable, real-time insight.

Focus on front-to-NAV integration, IBOR accuracy, automation, connectivity, analytics, and scalability when making your choice. Those are the real markers of a platform that will help—not hinder—your investment operations.

Further reading: