A real-time front-to-mid office platform tailored for active and complex ETF issuance

ETF Issuer Support & Software

ETF issuers face unique operational and portfolio management challenges, from intraday liquidity and tracking difference to accurate basket dissemination and multi-share class execution. Limina delivers a unified investment management platform purpose-built for ETF strategies, combining real-time portfolio visibility, integrated order management, and next-generation IBOR workflows that help you operate with precision, resilience, and confidence at every stage of the ETF lifecycle.

Built for modern ETF portfolio management

Real-time intraday liquidity and rebalancing

- Intraday cash management: Live cash ladders reflect pending creations and redemptions, corporate actions, and funding activity throughout the day.

- Dynamic rebalancing: Align portfolios with benchmarks or proprietary models intraday to minimise cash drag and control tracking difference.

- Drift and exposure visibility: Monitor portfolio exposures continuously as markets move and flows arrive.

Multi-share class and FX-hedged ETF support

Many ETF issuers operate globally and offer multiple share classes within a single fund structure. Limina natively supports this complexity.

- FX-hedged share classes: Manage currency hedging workflows, including forward positions and rolls, without impacting the core portfolio.

- Unified fund view: Maintain accurate P&L, exposures, and performance across unhedged and hedged share classes in a single system.

- Global readiness: Support USD, EUR, GBP and other currency classes across US, EMEA, and APAC markets.

Integrated ETF Order Management System (OMS)

Limina includes a fully integrated Order Management System designed for ETF trading workflows.

- Direct market access: Route orders to more than 500 global brokers or connect seamlessly to your preferred EMS.

- Full FIX connectivity: Real-time order submission, amendments, fills, and end-of-day workflows via FIX protocol.

- Multi-asset support: Trade equities, fixed income, and derivatives from a single blotter, including instruments used in buffer and defined outcome ETFs.

Operational control for ETF issuers

A third-generation IBOR for ETFs

Transitioning from T+1 mutual fund processes to the intraday reality of ETFs requires a live, authoritative data source.

- Real-time Investment Book of Record (IBOR): A single source of truth across positions, cash, and transactions throughout the trading day.

- Intraday NAV visibility: Identify discrepancies early, before they impact market makers or secondary market trading.

- Designed for T+0 workflows: Support the operational cadence of creations, redemptions, and rebalances as they occur.

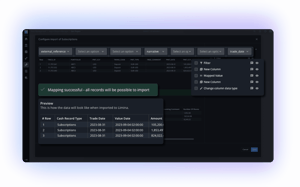

Agile connectivity with a native ETL tool

ETF ecosystems evolve quickly, with frequent changes to service providers, custodians, and authorised participants.

- Rapid onboarding: Connect to new counterparties, custodians, or authorised participants in minutes rather than weeks.

- User-configurable ETL: Operations teams can map, transform, and validate data feeds without custom development.

- Future-proof integration: Adapt easily as ETF structures, data requirements, and markets change.

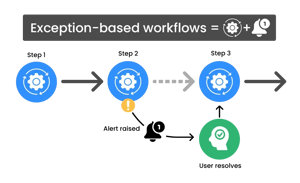

Automated PCF and basket management

Portfolio Composition Files (PCFs) are central to ETF liquidity and efficient market making.

- Intraday basket generation: Automatically produce and distribute accurate PCFs to authorised participants and market makers.

- Exception-based oversight: Automate the majority of daily reconciliations, allowing teams to focus on anomalies rather than manual processing.

- Operational confidence: Reduce operational risk while supporting tighter spreads and more consistent liquidity.

Key outcomes for ETF issuers

ETF challenge |

Limina capability |

Outcome |

| Managing active ETF strategies | Real-time portfolio and drift analysis | Maintain alignment with investment objectives throughout the trading day |

| Migration from mutual funds to ETFs | Live third-generation IBOR | Move from T+1 to T+0 visibility with confidence |

| Global product expansion | Multi-share class and FX hedging support | Launch and operate ETFs across multiple regions and currencies |

| Operational complexity | Configurable ETL and automation | Onboard new counterparties without development effort |

| Execution and liquidity management | Integrated ETF OMS | Execute efficiently and support tighter market-maker spreads |

Frequently asked questions

Supporting ETF issuers as they scale

Limina provides the intraday clarity, execution control, and operational flexibility required by modern ETF issuers. As active and complex ETFs continue to grow, our platform enables issuers to operate with confidence, precision, and speed.

Why companies are switching to Limina