Front Office Automation: 4 Platforms Transforming Investment Operations in 2026

Investment managers spend 60-80% of their technology budgets just keeping legacy systems running, leaving virtually nothing for actual innovation. Meanwhile, pre-tax operating margins declined 3-5 percentage points between 2019 and 2023 as operational inefficiencies compounded faster than AUM growth could offset them.

Front office automation solves this by digitising the investment workflow [from portfolio monitoring and order generation to pre-trade compliance and risk analysis] through exception-based systems that only alert users when something requires human judgment.

This guide examines four leading front office automation platforms designed for institutional use. Whether you're managing $100 million or $100 billion, understanding how these platforms differ on implementation speed, automation depth, and real-world usability will determine whether your firm spends the next decade maintaining yesterday's workflows or capturing tomorrow's alpha.

Note: This analysis consolidates publicly available information as of December 2025, including vendor specifications, user reviews from G2 and Capterra, and industry analyst reports.

Quick Comparison: Leading Front Office Automation Platforms

| Platform | Automation Approach | Cited implementation ranges |

Pricing | Client segment examples |

| Limina IMS | Exception-based, no-code | 3 weeks - 4 Months | Transparent ($39K+/year) | Firms managing $0.1-$30B |

| BlackRock Aladdin | AI-powered analytics | Quarters / Years | Enterprise custom | Global institutions ($50B+) |

| Charles River IMS | Rule-based execution | Quarters / Years | Enterprise custom | State Street ecosystem |

| SimCorp Dimension | Workflow-driven | Years | Enterprise custom | European insurers/large asset owners |

What Front Office Automation Actually Means

Front office automation refers to software that eliminates manual work from investment decision-making and execution workflows. Rather than "fully autonomous trading," it's about human-assisted workflows where technology handles routine tasks and only escalates genuine issues requiring judgment.

What it typically covers:

Pre-trade automation:

- Exposure and limit checks against investment mandates

- Cash calculations & simulations

- Benchmark deviation analysis

- Suggested orders generated from model portfolios or rebalancing logic

- Hard and soft compliance rules applied automatically

Order management:

- Multi-asset order creation, slicing, and routing

- Real-time status updates without switching between systems

- Alerts only when orders fail, breach limits, or require intervention

Data controls:

- Data ingestion with automatic validations

- Automated reconciliations ensuring data reliability

- Anomaly detection with context for rapid resolution

- Exception surfacing rather than continuous monitoring

Post-trade processing:

- Straight-through allocations, confirmations, and enrichments

- Manual intervention only for exceptions

Why it matters: Most managers still don't fully trust front-office data and lack automated controls, creating redundant manual checks and errors. When automation and data integrity work together, firms report dramatic efficiency gains.

The 2025 catalyst: With 90% of asset managers now using AI but only 8% having completed cloud migration, the gap between AI adoption and modern infrastructure creates operational friction. Front office automation platforms that combine cloud-native architecture with AI capabilities resolve this disconnect.

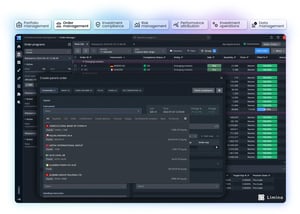

1. Limina IMS: Exception-Based Automation for Growing Firms

Who it's for: Mid-market investment managers ($100M to $30B in AuM) seeking institutional capabilities without enterprise complexity.

Core automation capabilities:

- Real-time Investment Book of Record (IBOR): Over 300 customisable measures updating in milliseconds; portfolio managers see live positions, exposures, cash projections, and compliance status without waiting for batch processing.

- Efficient workflows: The platform automates up to most of the work included in routine tasks like large portfolio rebalancings.

- Exception-based workflows: Rather than forcing users to monitor everything, it flags only anomalies requiring attention.

- No-code compliance engine & data ingestion: Ability to build custom compliance rules and data imports through drag-and-drop interfaces. Jobs & checks run automatically with full audit trails.

What makes Limina different:

Transparent pricing: Limina is the only provider to publicly list pricing; starting at $39,000 annually and scaling based on users, portfolios, and transaction volume (not AuM). Your software costs don't increase just because you attract more assets.

Implementation speed: Deployments range from weeks for new managers to months for established firms.

True cloud-native architecture: Built from scratch in 2014 for the cloud (not legacy systems retrofitted), Limina updates automatically every few weeks with no downtime or manual upgrades.

2. BlackRock Aladdin: AI-Powered Analytics at Enterprise Scale

Core automation capabilities:

- AI Copilot integration: Through Microsoft partnership, Aladdin embeds generative AI for scenario simulations, risk commentary generation, and predictive analytics; reducing manual analysis time for complex stress tests.

- Comprehensive risk analytics: Monitors 5,000+ multi-asset risk factors with sophisticated Monte Carlo simulation and stress testing capabilities that represent the industry gold standard.

- Full lifecycle automation: The Aladdin platform enables clients to manage the entire process from building portfolios and managing performance to operations and accounting. [Source]

- Private markets integration: Through eFront acquisition, provides a single vendor to support your public and private asset portfolios with valuations and cash flow projections.

Considerations for front office automation:

- Implementation complexity: "Build-a-city" deployments typically require quarters or years with teams of consultants. Even straightforward configurations demand extensive planning and coordination.

- Total cost of ownership: While pricing isn't public, annual costs are reported in the millions when factoring in licensing, implementation, customisation, and ongoing consultant dependencies.

- Sophistication tax: Mid-sized firms often find Aladdin's capabilities exceed their needs while its complexity strains resources. Features built for managing massive scale can overwhelm teams managing $5 billion.

- Conflict concerns: BlackRock's dual role as software vendor and competing asset manager creates potential conflicts, particularly for firms in similar investment strategies.

Head-to-head with Limina: Aladdin leads in raw analytical power for $50B+ institutions. Alternatives like Limina matches many features with less setup time and dramatically simpler user experience.

Examples of firms using it: Global asset managers, pension funds, and insurance companies requiring the deepest available risk analytics and willing to invest in large implementation projects.

3. Charles River IMS: Execution Excellence in the State Street Ecosystem

Core automation capabilities:

- Order and Execution Management System (OEMS): Industry-leading automation for order routing with sophisticated allocation algorithms and real-time execution analytics.

- Compliance automation: 376+ pre-configured compliance rules covering global regulatory requirements with automatic pre-trade, intra-day, and post-trade monitoring.

- Real-time IBOR: Cloud-native deployment on Microsoft Azure delivers live position updates and multi-asset class support, though architectural constraints from pre-cloud origins are cited.

- Trade lifecycle automation: Automated affirmation, settlement instruction generation, and reconciliation; particularly seamless for State Street custody clients.

What makes it different:

Charles River's OEMS represents the execution management gold standard. Its broker connectivity and routing sophistication handle the most complex order workflows with precision that trading desks demand.

Considerations for front office automation:

- Ecosystem dependency: Maximum value requires integration with State Street's broader services. Firms outside this ecosystem may face longer, more complex implementations and higher integration costs.

- Implementation timelines: Deployments that span many quarters strain non-aligned users, with external integrations requiring substantial technical coordination.

Head-to-head with Limina: Charles River excels in broker depth and execution sophistication. Limina's no-code tools enable faster configuration and integrations, both for initial setup and when change occur in production.

Examples of firms using it: Institutional managers with complex compliance requirements or existing State Street custody relationships, firms prioritising execution quality and regulatory risk management.

4. SimCorp Dimension: Regulatory Depth for European Institutions

Core automation capabilities:

- Unified database architecture: Single source of truth across front, middle, and back office with particular strength in complex derivatives and multi-currency portfolios.

- Regulatory reporting excellence: Native support for 70+ reporting jurisdictions with automated generation of required filings.

Multi-asset sophistication: Handles exotic derivatives, structured products, and insurance-linked securities with precision required for institutional risk management. - Integration with Axioma: Post-Deutsche Börse acquisition, enhanced factor-based risk analytics and portfolio optimisation capabilities.

What makes it different:

SimCorp's regulatory reporting capabilities represent the European standard. Insurance companies managing complex liability structures rely on its precision for matching assets to liabilities across currencies and jurisdictions.

Considerations for front office automation:

- Legacy architecture: On-premise roots mean "cloud transitions" are really "cloud lifts"; moving existing architecture without gaining true cloud-native benefits. This impacts upgrade flexibility and real-time performance.

- Implementation complexity: deployments require extensive training and specialised consultants, with steep learning curves that strain teams during cutover periods.

Head-to-head with Limina: SimCorp's regulatory reporting depth and accounting functionality outperform Limina. Capabilities in compliance and operations are comparable. Limina is a great pick for cloud-native real-time processing, slick Front Office workflows and quicker change management (implementation & in production).

Examples of firms using it: European insurance companies and large pension funds requiring deep regulatory compliance, firms managing complex derivative books and multi-currency liability matching

Decision Framework: Matching Platform to Firm Profile

| If you are... |

Consider... |

Why |

| Mid-market asset manager ($100M-$30B) seeking institutional automation capabilities without complexity. | Limina IMS | Exception-based automation, transparent pricing, fastest implementation |

| Global institution ($50B+) requiring deepest risk analytics and unlimited budget | BlackRock Aladdin | Industry-leading Monte Carlo simulation, proven at massive scale, comprehensive AI integration |

| Existing State Street client prioritising execution quality | Charles River IMS | Seamless ecosystem integration, best-in-class OEMS, 376+ compliance rules |

| European insurer managing complex liabilities | SimCorp Dimension | Regulatory reporting excellence, multi-currency precision, derivatives depth |

Limina delivers institutional automation capabilities at mid-market economics with implementation timelines measured in weeks rather than years.

The 2025 Automation Imperative

Three converging forces make front office automation essential now, not optional later:

1. AI demands modern infrastructure

90% of asset managers use some form of AI, but AI capabilities require cloud-native platforms with real-time data and modern APIs. Legacy systems can't support the AI integrations that drive alpha in 2025.

2. Margins demand efficiency

With pre-tax operating margins declining 3-5 percentage points and 80% of technology budgets maintaining legacy infrastructure, firms suffer on the bottom line from operational inefficiency.

3. Competition demands speed

Markets reward firms that act decisively on opportunities. When you observe assets move, being nimble to launch is one of the most important competitive advantages as an investment manager.

Making Your Choice

Front office automation selection determines whether your firm spends the next decade maintaining yesterday's workflows or capturing tomorrow's alpha.

For mid-market firms ($100M-$30B AUM) seeking institutional capabilities without enterprise complexity, Limina IMS delivers the rare combination of modern architecture, transparent pricing, and exceptional speed.

For the largest institutions requiring the deepest risk analytics or the most comprehensive regulatory compliance, enterprise platforms remain relevant despite their complexity and cost. But recognise the tradeoff: multi-year implementations, opaque pricing, and ongoing vendor dependency in exchange for proven scale.

The competitive advantage goes to firms with agile infrastructure; platforms that update automatically, integrate effortlessly, and free teams to focus on investment decisions rather than system administration.