Investment Management Software Explained: What Asset Managers Should Know

Executive summary (tl;dr) - identifying the top investment software for You

The operating model of the future is one front-to-NAV solution at the centre. It consolidates functional capabilities and asset classes, which enables end-to-end workflows and centralised cash and data management.

For a system to service all asset classes and functional capabilities, it must be able to represent your portfolio in any way (with/without specific transactions and cash movements), at any time (past, present, future) and trade/settle date. This is known as an IBOR generation 3; only one such solution exists today (Limina).

Additional considerations when selecting the best investment management software company to work with include:

- Connectivity: Can users set up and change connections in less than 10 minutes? Or will you rely on the provider (for a cost and time delay)?

- Work from anywhere & no IT footprint. With a modern cloud-based investment management platform, you should have access from your phone and not worry about upgrades.

- Smooth workflows & cost control. The most powerful lever for your business, is ensuring that Front Office don’t spend their time raising orders (i.e. should be super fast & robust) and operations rely on exception-based workflows.

About the authors

As former investment managers, we struggled to find transparent and unbiased information about investment management systems (IMS). We felt vendors always tried to put their solution forward as the best option. The truth is that no two investment managers are the same, and no software can be the best choice for everyone.

This guide is our attempt to provide an unbiased guide to capabilities to consider and compare when looking for the best investment manager software, be it for fund vehicles, managed accounts or internal assets. Feel free to connect with our CEO, Kristoffer Fürst, on LinkedIn - where he publishes transparent content around operating models, technology, vendor evaluation, etc (that he wishes he had access to when on the buy-side).

Transparency disclosure: Limina provides an IMS (Front-to-NAV), and in the name of transparency, we have created two public articles about what firms Limina is most suited for and when Limina might not be the right choice.

All investment workflows in one place

Limina's Investment Management Solution (IMS) combines the workflows you need with powerful data & automation capabilities - all in one solution.

What is an Investment Management System?

Investment Management Software is a software suite, not a point solution. An IMS covers front-office and middle-office workflows, and sometimes (but not always) back-office. If the latter is included, it can also be called a front-to-back office system. IMSs typically don’t provide shareholder registry or general ledger functionality.

We illustrate functional capabilities below, where you can also see that performance attribution and risk (scenarios and stress tests) are optional add-ons and might not be part of an investment software system.

The design of Limina allows it to fit multiple operating models without custom code. It can, for example, start as a pure OMS / PMS or be the entire front-to-middle office solution. In cases where back office functions are outsourced, some of our clients don’t run an accounting platform and instead rely on Limina as the only system for all their needs. The blue colour in the illustration above indicates where we can fit, depending on your target operating model.

Why consolidate?

The buy-side financial services industry is evidently moving away from niche investment management tools, or best-of-breed as it’s also called – illustrated in the right in the illustration above. There is a clear trend towards more all-in-one systems, such as Front to Back or IMS.

The main reasons are:

- Cost reduction, thanks to fewer software licenses and less connectivity cost (usually internal resources).

- Less data synchronisation. With a centralised data set, data synchronisation issues such as data gaps and timing issues are avoided. The data should be standardised across asset classes and functional areas (as with Limina).

- Workflow efficiency for both Front office and Operations is achieved through end-to-end workflows within one system. We’re observing a new shift happen, where investment managers evaluate the efficiency of workflows as part of a system selection. Beyond functional capabilities, investment managers ask prospective providers, “How easy is it to use?”. Not just when things go as expected, but maybe more importantly when there are inevitable issues. More about that later in this article.

The one exception to the system consolidation is execution, where sometimes it’s more efficient to have a separate investment trading software (also called “Execution management system”) because of nuances in a specific market.

Capability descriptions

These are the main functional areas of an IMS. Highlighted is where Limina’s IMS is uniquely strong.The core of an IMS: Investment Book of Record (IBOR)

IBOR is a fancy word for how a system handles positions and cash. All investment management applications must handle positions and cash and, therefore, need an IBOR. There are 3 types (or generations) of IBOR:

- Flush & fill (Gen-1). Positions and cash are refreshed from an accounting system or fund admin in the morning.

- Rolling balance (Gen-2). The classic accounting principle, where today (T) is built from yesterday (T-1) plus all activities since. This approach creates one stored, “true view” of the portfolio per point in time.

- Live-extract (Gen-3). All activities are stored and any portfolio view is created on demand, with a specific cash state (preliminary or confirmed), investment state (simulated, in-market, committed, etc) and point in time (past, present, future).

Type-2 struggles since it has just one stored view, so views for the front office are built from adjustments to that one view. Type-2 doesn’t achieve completeness, and sophisticated requirements like planned future trades aren’t supported.

Type-2 and type-3 are self-reliant and can be used for reporting and reconciliation/duality. And neither requires more maintenance than type-1.

Type-3 IBORs provide the entire team, from portfolio managers and traders to compliance and operations, always see what they need. To our knowledge, only one IMS is built on a type-3 IBOR, which is Limina.

Exception-based workflows

Limina enables smooth workflows and strong automation capabilities so you can get your work done quickly, from anywhere.

Considerations when selecting investment management solution

Below we list the key things to look at, when deciding which IMS to select. Click each tab to open information about that area.

Smooth, intuitive workflows

We believe smooth, effective workflows are the best approach to reduce time spent on non-alpha-generating activities and increase governance. There are 3 ways to achieve this:

- Full automation is incredibly hard and usually not worth the effort, especially in an industry where issues are nuanced and unpredictable. The failed STP projects across the industry are sad proof of this point.

- Increase efficiency, i.e. trying to do more tasks, faster. This most often leads to marginal efficiency gains - not breakthroughs.

- Exception-based workflows: the system automatically performs any task that resides on a calendar, or that can be described as “check that”. Your team is notified if something unexpected happens. Example tasks include data import & export, data enrichment & data validation.

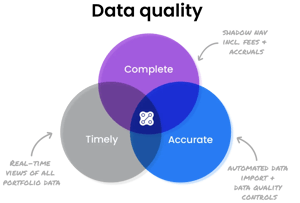

Data connectivity & validation

There are 3 approaches to connectivity for investment management platforms in the cloud. All vendors offer two; 1) managed integrations and 2) API/database access. Limina uniquely offers the 3rd: a native no-code import/export application that lets your team build integrations in minutes.

Read more:

3 connectivity approaches

Some IMSs come with data management capabilities, removing the need for separate investment data management systems. Limina is such a system, with built-in data validations and quality controls, both for native data models and for custom data (such as classifications).

No IT footprint

Nowadays, you shouldn’t need any IT overhead associated with a system. There is fully managed, cloud-native software for all sizes and types of investment companies. The vendor should manage hosting, access (web & mobile app) and upgrades without professional services (consultancy) fees. If not, we recommend you remove that vendor from the list; plenty of modern (cloud-based and web / online) investment management tools exist.

Whether you run “office first”, fully remote or hybrid approaches, a cloud-based investment management software has got you covered. Limina IMS has been designed from the ground up as a cloud-native platform.

Read more:

Enterprise functionality

Some IMSs are built to service simple use cases, while others are built to service more sophisticated workflows or niche investment styles. We keep a list of all systems and when they’re a good fit, respectively. Feel free to connect with our founder, Kristoffer Fürst, and request the latest list.

Limina IMS is best suited when workflow sophistication is medium to high or when automation/efficiency is an important consideration when selecting a system.

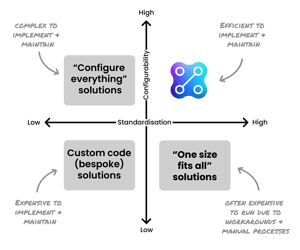

Custom vs off-the-shelf vs enterprise cloud

In our experience, the best financial investment software is the “enterprise SaaS” for most investment managers, except for the absolute smallest or largest in the world.

Read more:

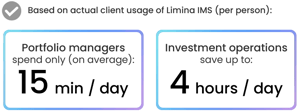

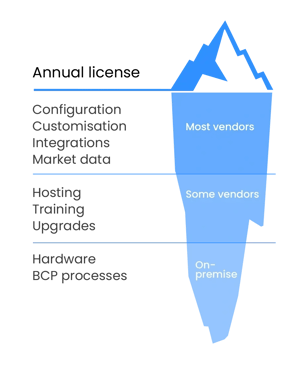

Reduce & control costs

When selecting an investment management platform, the total cost of ownership (TCO) is usually more than the investment system cost (see image to the right). For some older technologies, ongoing maintenance and upgrades might incur significant fees – but today, modern alternatives are available.

The most important and challenging aspect to analyse is workflow efficiency. At Limina, we’ve helped clients reduce time on operational workflows by up to 50% and the average Portfolio Manager spends 14 minutes in the system daily (down from more than 1 hour before).

We recommend choosing a provider with pricing published publicly on their website. You want to know the price, right? A vendor that shows it signals that they are a true partner, not just claim to be.

Read more:

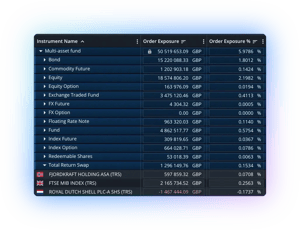

Asset class coverage

Historically, there was no front-to-NAV system with solid capabilities for all asset classes. So, investment managers had to rely on separate investment management systems for their different instrument types.

At the same time, reducing the number of investment management systems is obviously the best operating model of the future.

There is not much else to say on this topic. Limina set out to build an all-encompassing solution to help investment managers on their journey towards a single top investment management software. Our clients trade various products across public markets (equities, futures, options, ETFs), alternatives, debt/fixed-income, FX, OTC (swaps, options) and funds.

A lot more than "just another IMS"

See how Limina can help!

Want to see how Limina can help you save valuable time in your daily investment management workflows?