EMS vs OMS vs PMS: Understanding the Front Office Solutions

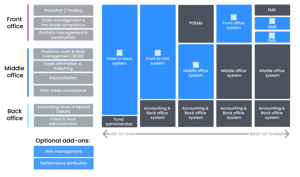

This article will examine the three systems typically used in the Front Office of Investment Managers: the EMS vs OMS vs PMS. We summarise the scope of each and look at how systems could cover all or part of the three capability areas.

If you prefer to watch instead of reading, our founder and CEO, Kristoffer Fürst, walk you through everything you need to know about OMS, PMS and EMS in the video below (if you prefer to read, scroll past the video).

As former buy-side professionals, we know that honest and transparent material is hard to come by. In the financial services industry, it sometimes feels like everything is a pitch for a system or service.

For full disclosure, Limina offers a Trade Order Management System and a Portfolio Management System (POMS), but not an Execution Management System (although we can route orders directly to brokers). Our Solution is broader than those functional areas, an entire Investment Management System covering front and middle office workflows. This article isn’t a pitch for our solution (or any other solutions). If you’d like to learn when Limina could be an excellent match for your needs, we have a separate article for that and for when Limina might not be the right choice for you.

What EMS, OMS and PMS Systems Do

We go through EMS, OMS and PMS in order they are used in the workflow of a Portfolio Manager:

- From the construction of portfolios (PMS),

- through generation of orders (OMS),

- to executing them in the market (EMS).

Portfolio Management Software (PMS)

A portfolio management system can mean two different things:

- For Asset Managers, it’s a Front Office used to construct, manage and model portfolios.

- For Hedge Funds, it’s a back-office system.

Here, we focus on the definition as used in the Front Office. You can read more about both use cases in our dedicated article on what a Portfolio Management System is.

When an Asset Manager uses a PMS, the goal is typically to arrive at a target portfolio. Two examples are which holdings your “SA Equities” portfolio should have or the duration profile of your “High Yield” portfolio. To this end, a PMS has tools to analyse the impact of exposure, analytics and risk when making hypothetical changes to an existing or entirely new portfolio.

Order Management System (OMS)

An Order Management System (OMS) takes on where the PMS left off. We have the target portfolio from the PMS and need to turn it into reality. Let’s say we have a fund called “Balanced Global” that should have a 10% allocation of the “SA Equities” portfolio and a 20% allocation of the “High Yield” portfolio. We configure this relationship in the OMS, linking the model portfolios to the actual funds.

If an event triggers a drift from the target, for example, an inflow from investors or a change of the models, we want to rebalance the fund against the target portfolios – which the OMS handles. A portfolio rebalancer is more complex than it would first appear since the system needs all information about the portfolio, including cash, to perform this task.

Some OMSs cut corners by not having complete cash data, using a “flush and fill” approach to either cash or positions. This incompleteness means you need to keep cash buffers to avoid an overdraft. Even if such a cash buffer is small, it will noticeably impact your performance. See the impact for yourself with our Operational Alpha Calculator.

Lastly, the OMS will assemble the resulting orders and create program or basked trades as needed. Most OMS supports rules-based automated trading or routing for manual trade execution.

What is an Execution Management System (EMS)?

Lastly, you need to execute the orders. An OMS platform will send the trades to either an Execution Management System (EMS) or an outsourced trading provider. The OMS can also route orders directly to sell-side brokers, especially in simple trading cases.

An EMS aims to help traders execute orders in the markets. Already here, we can observe an important difference between OMS/PMS and EMS: the EMS is used by Traders, while the OMS and PMS are used by Portfolio Managers.

The EMS is connected directly to trading venues, often including direct market access (DMA) to exchanges when trading equities. Speed and efficiency are essential in an EMS to ensure the execution at the best price possible. To that end, it usually has embedded real-time market data, which an OMS sometimes also has.

The circle is closed by the EMS sending executions or fills back to the OMS. Since the OMS – as opposed to the PMS and EMS – has all the information about portfolios (and hopefully cash, unless it's "flush and fill"), it’s usually the system of the three that connects to downstream systems in the middle office. The OMS typically handles trade instructions for allocations and sometimes settlement instructions.

In the case of Limina’s IMS, the middle office system is the same as the PMS and OMS, so workflows continue into operations seamlessly.

Consolidating Systems: EMS vs OMS vs PMS

Consolidating systems in the Front Office makes intuitive sense since the workflow from one flows naturally to the next, from PMS to OMS to EMS. Combining PMS and OMS makes a lot of sense, especially since the same user (Portfolio Manager) uses both. EMS is less important to consolidate since A) it's a different user and B) the amount of data that flows between OMS and EMS is standardised and straightforward (orders via FIX).

Consolidating PMS and OMS: the Portfolio Order Management System (POMS)

If you put a PMS and OMS together, it makes the portfolio planning and order-raising process simpler. The PMS helps portfolio managers create target portfolios, and the OMS help them raise orders accordingly.

Since trade compliance software is usually part of the OMS, with a combined Portfolio and Order Management System, pre-trade compliance can also become part of the PMS workflow, catching issues earlier simplifying the workflow for Portfolio Managers.

Combining EMS and OMS: the Order Execution Management System (OEMS)

Combining an EMS and OMS is unclear how much benefits it gives. In theory, traders don’t have to switch between multiple systems, taking staged orders from the OMS and sending them to the EMS. In practice, however, that integration is already very smooth for most OMSs and EMSs.

Consolidating All Three: the POEMS (Portfolio Order Execution Management System)

With all three in one, it becomes a holistic Front Office offering. As a general rule of thumb, more capabilities within the same solution will reduce the cost of your investment systems.

At the same, there are few such solutions available, and those that exist usually don’t cover the Middle Office well, so the tradeoff is inefficiencies and costs elsewhere. In order to maximise operational efficiency, Middle and Front Office workflows need to be connected.

Given the choices in the market today, at Limina, we believe the best option for most Investment Managers is:

- A Portfolio Order Management System natively part of the Middle Office technology which is also a live-extract 3rd generation IBOR System and

- Choosing a separate EMS or outsourcing trading.