The enterprise platform that delivers real-time portfolio visibility at scale

Limina provides institutional asset managers with a unified platform for equity portfolio management. Monitor exposures instantly. Process corporate actions automatically. Maintain compliance across all mandates.

Designed for growing firms managing $100M-$30B who need to scale operations efficiently.

"The move has enabled more efficiencies and automation in dealing and portfolio rebalancing. This has been achieved while at the same time keeping the absolute highest quality in compliance controls."

A unified platform for enterprise equity management

Limina delivers accuracy, efficiency, and scale by integrating position tracking, compliance, and risk into one real-time system.

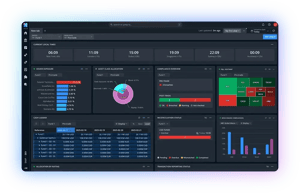

Track & monitor with complete visibility

Get a real-time picture of your entire equity portfolio.

- Dynamic dashboards with time-series performance tracking and portfolio rankings (top performers, P&L heatmaps)

- Drill-down analysis from portfolio level to individual stock positions, including trade details and settlement status

- Track corporate actions automatically with forward-looking visibility of dividends, splits, and rights issues

Users report 50% reduction in manual tasks.

Analyse & execute with confidence

From analysis to execution, make decisions with current data.

You can optimise cash-level as low as 2 basis points with sophisticated order planning functionality.

Manage risk & compliance proactively

Prevent breaches before they occur.

- Break down ETFs, funds, and derivatives to see individual stock exposures

- Analyse recursive look-through across multiple layers of holdings

- Easily digestible exposure & performance management

- Understand your returns with performance attribution models

- Track true exposure across sectors, countries, and individual securities

Capabilities that set Limina apart

"As a portfolio manager, I think the system is very user-friendly. It's a modern, cloud-based system that is very adaptable to my needs in extracting information."

Powered by a real-time Investment Book of Record

Our entire platform is built on a foundational IBOR, which is the engine behind your confidence.Model any scenario and see its true impact on your portfolio immediately, including projected cash through all settlement cycles like T+1 and T+2

A solution for your entire firm

- For Portfolio Managers: Analyse portfolios with real-time positions, performance tracking, and drill-down capabilities

- For Trading Desks: Create and manage orders through their lifecycle with pre-trade compliance checks

- For Compliance Teams: Fully integrated pre- and post-trade compliance with automated monitoring

- For Operations: Automated trade affirmation, reconciliation, and corporate action processing

- For Risk Management: Real-time exposure monitoring, VaR calculations, and stress testing

Stop tracking portfolios in spreadsheets

See how Limina can help you with your stock portfolio tracking software