How to Increase Trust in Investment Data with Limina’s IMS

In the fast-paced world of the front office, confidence in your investment data is paramount.

First of all, your entire portfolios must be represented. There can’t be gaps with some positions or cash not reflected. Secondly, your access to data must be real-time.

Thirdly, you need to be able to view your portfolios from multiple perspectives. For example with simulated orders and the resulting potential commissions, fees, coupon payments or dividends. Only then do you gain a sense of trust and control.

Moreover, knowing that your operations team is on top of the data provides confidence in a proactive approach to resolve data issues.

As former investment managers now serving as vendors, we make claims about what we can help clients achieve. The difference is, we can substantiate all our claims. We believe in transparently assessing whether our solution is a perfect fit for your needs or not.

This is one article in a series of five, where we go into the claims we make. This article is about we help our clients increase trust in their investment data. To view the other articles, please click on the links on the side of this article or you can view them on the claims we make page.

The below video features our Chief Product Officer, Joakim Saltin, and Product Manager, Philippe Ramkvist-Henry. They explain why we claim that the Limina IMS can help you trust portfolio data that you see.

All Investment Data Represented

As an asset manager, the completeness and accuracy of portfolio data are crucial to your decision-making process.

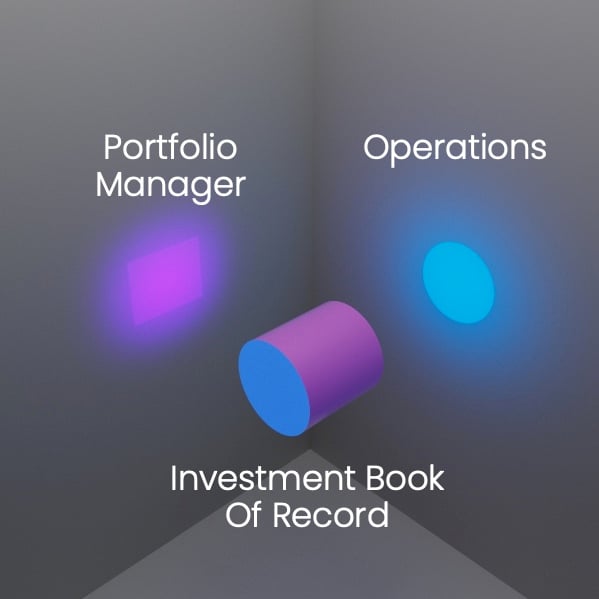

Limina's IMS combines cross-asset OMS Trading functionality and Investment Book of Record Technology in one solution. This ensure we can bring together all trading and non-trading records in real-time.

This provides you with complete and accurate real-time portfolio views across the trade lifecycle. From simulations and cash estimates all the way to matched and settled trades. As a result, you can trust your portfolio data, which is always current, accurate, and presented from the perspective you need.

Data Quality Controls to Increase Investment Data Trust

It's not just about having all data represented; it's about ensuring that data is accurate and trustworthy. Limina's IMS has built-in safeguards, like fat finger checks for data entry, reducing the risk of manual errors.

More importantly, it provides robust data quality controls, strong connectivity, and exception-based workflows.

These tools empower your operations team to produce world-class data quality, further enhancing your investment data trust.

Conclusion

Limina IMS is an enterprise investment management software, engineered in Sweden for the demanding requirements of mid-sized investment managers. We believe trusted data should be something to take for granted.

As such, we’ve created capabilities and controls to ensure:

- All investment data can be represented in the system

- Portfolio data is as accurate as possible, even when it originates outside Limina

- All investment data is accessible as quickly as possible, including cash movements intraday

If you’d like to see how we do it, please book a demo with our team of former investment managers.