Best Fund of Funds Software: Features & Benefits for Asset Managers

What is Fund of Fund Software?

Fund of funds software is designed to meet the specific needs of investment firms and allocators that invest in multiple funds rather than in individual stocks, bonds or other asset classes directly.

Fund of fund software can mean different things. Here, we focus on what it means for allocators and investment managers investing primarily in mutual or hedge funds (where the system is called Fund of Hedge Funds Software). We also include Limited Partners (LPs), such as trusts and multi-family offices that invest in Private Equity (PE) and Venture Capital (VC) funds.

Note: There are other definitions of fund of fund software when used by PE and VC firms. In these cases, the General Partners (GPs) of those firms use the software to manage, for example, capital calls. In this article, we’ll not focus on use cases within PE or VC firms but on investment firms and allocators that are the investors in mutual funds, hedge funds and PE/VC funds.

Fund of Funds Portfolio Management Software: 4 use cases

The investment lifecycle of a fund of funds manager consists of several discrete steps, with systems that can support each of those steps. Below is a high-level summary:

1. Manager Selection & Optimisation

For allocators, there are several steps before an investment in a mutual and hedge fund is completed. The first step is selecting the best managers and allocating the right amount to them. Specialised systems and tools exist, such as AlternativeSoft and eVestment. This software can calculate the performance, risks and correlations of various funds and help you make informed decisions about whether to allocate and how much.

2. Look-through: Portfolio Management and Compliance

Look-through is critical for allocators to funds. Setting up constituents must be supported through actual underlings when they are known, e.g. equity or bond holdings.

In some cases, you might not know the underlying holdings fully or at all, in which case exposure should be possible to approximate. For example an approximated exposure for a hedge fund to certain sectors or geographical regions.

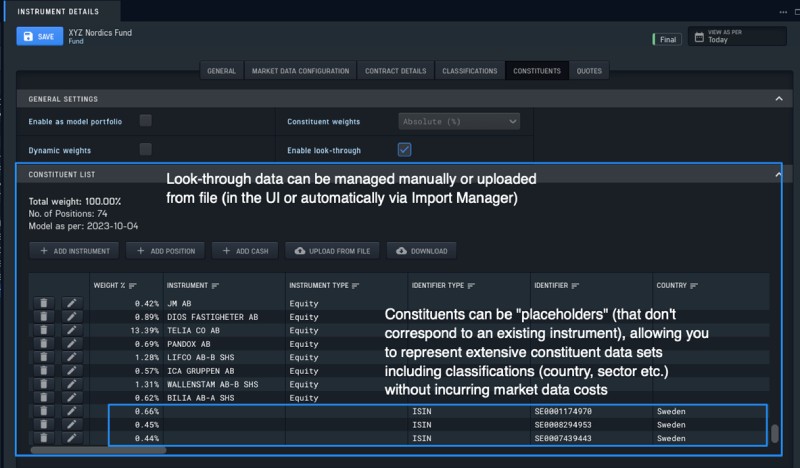

Limina supports all these look-through setups. Here is how the config looks in the user interface:

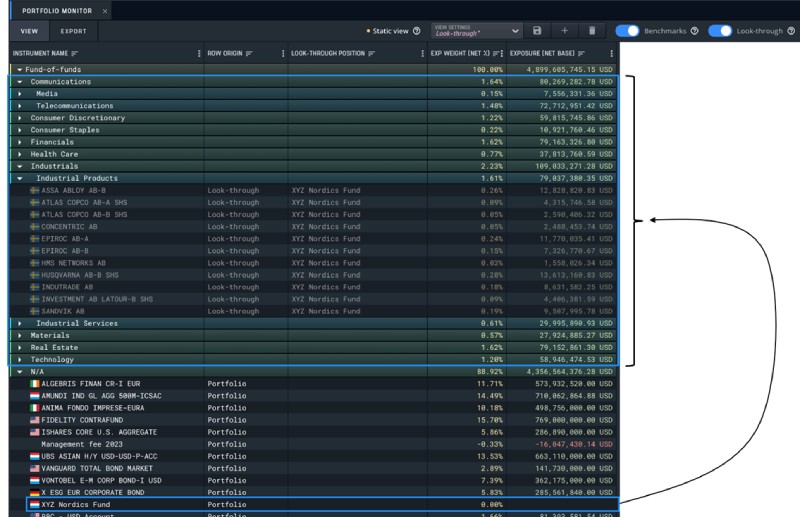

Once constituents are configured, Portfolio Monitoring Software capabilities are one of its use cases. Portfolio monitoring includes features such as slicing and dicing the portfolio based on underlying instrument characteristics, such as country, sectors, issues, ESG factors, etc.

Important to note is that if the fund holdings themselves hold derivatives, indices or other funds, the system must be capable of multi-layered look-through. Limina’s software can do this, and below is an example of such a portfolio view:

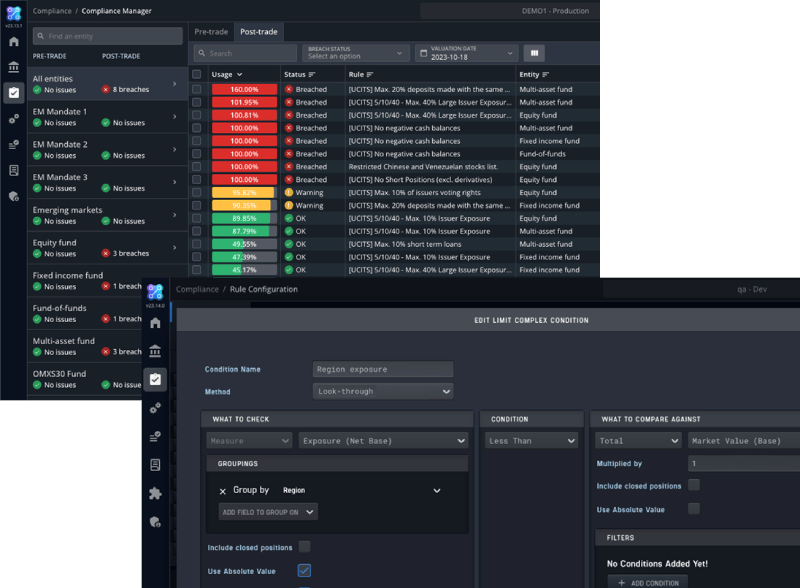

The second essential use case of look-through is within the trade compliance software. Compliance rules must be able to run checks like sector, regional or issuer exposures on a constituent level. Let’s say you have a restriction that you can’t invest in a particular industry. This constraint is part of your selection criteria when allocating to a mutual fund or hedge fund manager.

Then, you need a tool to create an audit trace that this was checked before investment (pre-trade compliance). With the right tool, you can monitor compliance rules continuously to ensure no compliance rule is breached as your selected managers change their holdings.

Here’s how Limina compliance reports look like within the system:

3. Cash Management and Trade Order Management Software

While trading doesn’t happen in the same way for mutual fund orders as for equities, bonds, FX and derivatives, there are still vital aspects to consider at the time of investment and divestment.

Since settlement days differ on sell and buy, it’s crucial to have a forward-looking portfolio view (exposure ladder) into the future when placing an order. When rebalancing, the system will show new sector, regional, etc exposures including for funds where you don’t know the constituents and have instead approximated these.

Equally important is to have a cash ladder view, for example, if you swap one fund for another, to ensure payments arrive before they are due.

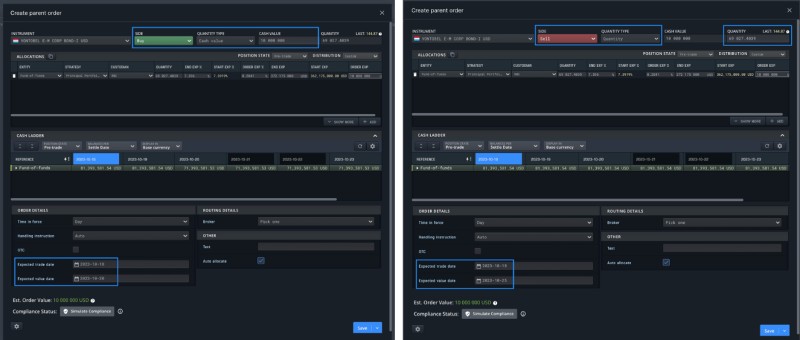

Another final consideration is that buying mutual funds is often done with monetary amounts (cash), while selling is done based on units. The result is that a buy and sell might not match since there is uncertainty on the monetary amount of the sale until a NAV is cut on the settlement date. Your system needs to consider this and visualise the uncertainty so you can make informed decisions about cash buffers.

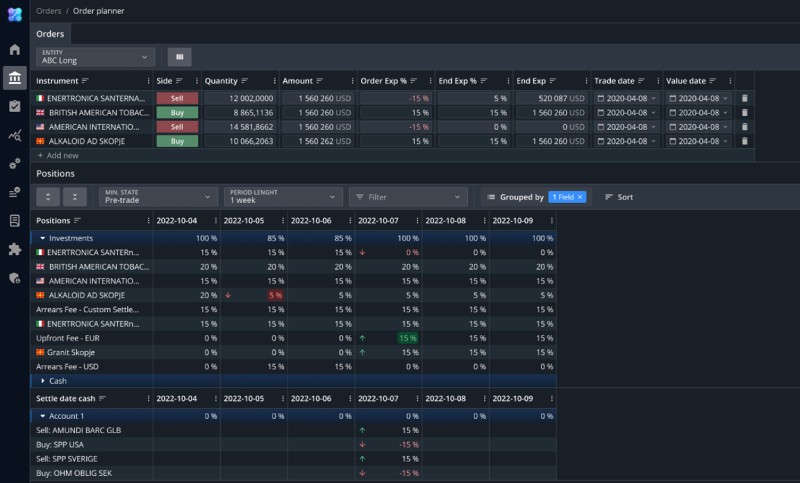

Limina supports both quantity vs cash type orders and varying settle date cycles. Here is how the orders look within the system:

Once you have entered simulated orders into the Limina system, the resulting exposure and cash ladder views show you the result. These views allow you to analyse and spot any concerns before placing the orders with the respective funds. Here’s how the order planner module looks:

Once orders are created, some fund of fund software (such as Limina) is able to send them for electronic execution.

4. Fund of Funds Accounting Software

While the topic often arises, the accounting requirements aren’t materially different for a fund of fund manager vs any other investment manager. Of course, the accounting system needs to support mutual fund and hedge fund investment, but these are very straightforward from an accounting point of view.

PE and VC fund holdings are more complex since the accounting system needs to model the capital calls and committed capital. So, if you invest in PE of VC funds, check that any fund of funds accounting software also supports those fund types.

Limina’s Fund of Fund Software

Limina Investment Manager Software (IMS) supports look-through in both compliance and portfolio tracking. When raising orders, our software will help you review cash and exposure impacts today and each day in the future, to plan low but safe cash buffers.