Enterprise Investment Management SaaS: Features, Benefits & Use Cases

Why read this guide?

It’s our hope that by the end of this guide, you should know:

- What all buzzwords like cloud-native, enterprise SaaS etc mean

- How we got to the current system landscape within front office and middle office

- What the future holds for investment technology

- The pros and cons with choosing different types of cloud solutions

- Which type of software is the best fit for your firm

- Introduction

- Benefits

- For whom

- Why this guide

- Terminology

What is enterprise SaaS?

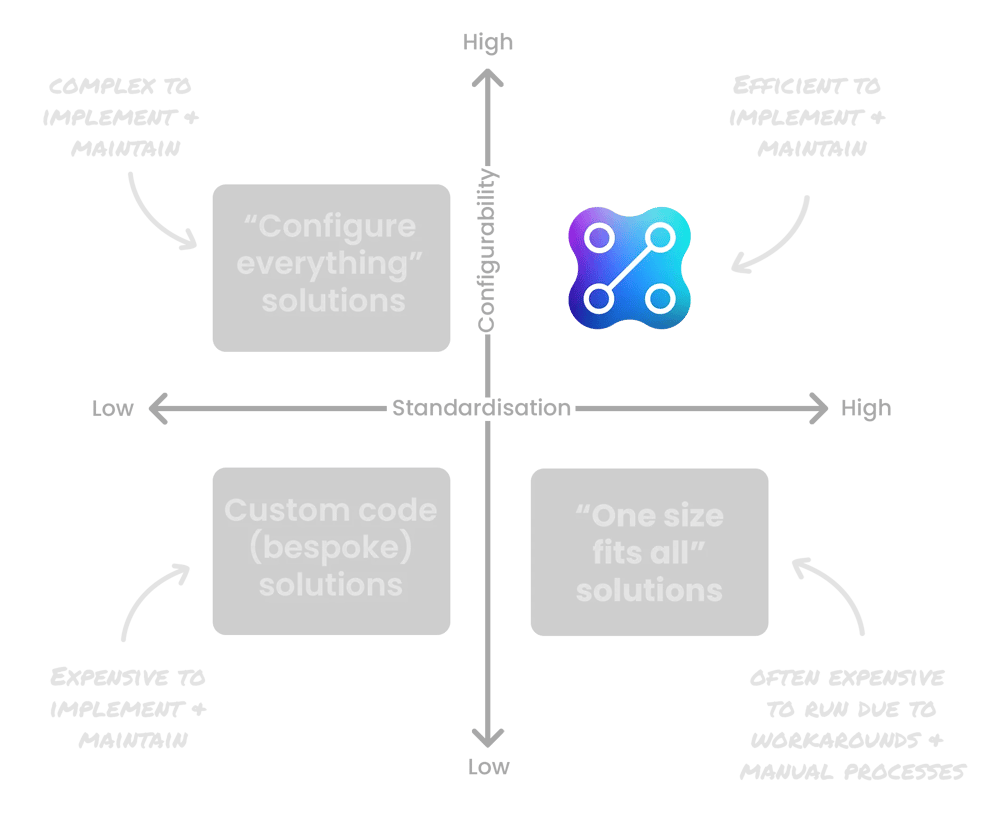

Enterprise Investment Management SaaS is the 4th evolution of how software is delivered to asset managers. It offers an attractive combination of the mass market benefits of one-size-fits-all SaaS (generation 3) such as lower total cost of ownership, managed upgrades, and transparent pricing.

At the same time, it retains some of the benefits that came with older solutions (generation 1 and 2) including customisability and isolation of your portfolio data.

What benefits does it provide?

Enterprise SaaS provides some benefits througth technology (e.g. customisability) and some with better processes (e.g. upgrades). Frontier functional includes:

- Data import and export, allowing non-technical staff to configure and change integrations.

- Configurable data quality checks to check and flag e.g. large P&L movements and to spot data entry mistakes in real-time.

- Approval workflows, way beyond “just” orders and compliance.

- Exception-based workflows to flag issues as they happen, such as a file not delivered as expected or an instrument parameter missing that is needed for compliance.

Who is this guide written for?

If you’re a CEO, COO, CIO (Chief Investment Officer), Business analyst, Consultant or in any other way involved in system selection and/or implementations on the buy-side; this guide is for you!

This is equally relevant if you’re involved with or concerned about change management, business development, launching new strategies and portfolio or operational oversight.

Why we created this guide

As former investment managers, we were fed up with vendors who clearly didn’t know what it was like to sit in a volatile market, with a redemption coming and not knowing if our portfolio data was correct.

We felt we were overpaying for the service we got, that the solutions were cumbersome to implement or didn’t offer enough flexibility to support our alpha-generating workflows.

Hence, Limina was created out of frustration. We set out to develop, deliver and service an Enterprise SaaS Front to Middle office solution for asset managers. We chose an Enterprise investment management SaaS solution after a lot of research on the topic. However, we recognize that Enterprise SaaS isn’t for everyone.

Having been in your shoes, selecting systems, we know that transparent information is hard to come by. We created this guide for the same reason we started Limina, to offer something (in this case honest information) that we wanted but couldn’t find. Hopefully this guide can save you time and maybe even help you avoid a costly mistake of choosing a suboptimal solution, whichever that solution might be.

Terminology used

In this post, we refer to various front office and middle office systems, which are meant to serve as examples and hence we use them interchangeably throughout the guide:

- Portfolio Management SaaS (PMS)

- Order Management SaaS (OMS)

- Investment Management SaaS (IMS)

- Investment Books of Record (IBOR)

“I’ve tried my best to use plain English and to cut out anything that’s not material. At the same time, the aim has been to cover the topic deeply enough so that this can serve as the only educational resource you need on cloud or SaaS.”

- Kristoffer Fürst, CEO Limina, former Front-Office Quantitative Analyst

Definition of Enterprise Investment Management Software

- 01 On-prem

- 02 Hosted

- 03 Multi-tenant SaaS

- 04 Enterprise SaaS

Generation 1: On-premises software

On-premises software is when the vendor delivers code to you. It’s up to you to host it, on virtual or physical servers. You get new code delivered periodically and decide when to upgrade. And you are fully responsible for the testing of an upgrade.

"With an on premise system, upgrades take a considerable amount of time and effort, and generally we upgrade annually – meaning we have to wait a long time for software improvements.

It also means we have to spend valuable resources on non-core activities such as hosting and IT maintenance. With the current cyber environment and frequency of security patching, on critical systems for us this is a manual, out of hours, process that means Production systems are unavailable. We are strategically moving to SaaS for some critical systems, so that not all our key systems are running in the same environment. This makes BCP/DR more layered – and gives us more options, and less likelihood of all systems outage."

- Head of Technology, $9bn Asset Manager

Car analogy: You own a car and park it in your garage. You pay for the car upfront or take a loan to finance it. Additional costs include the garage (you must build, buy, or rent it). You’re also responsible for maintenance, both paying for it and taking the car to and from the service centre.

Hosted solution (cloud-enabled)

With a hosted solution, the vendor is responsible for running (or hosting) the software. You are still responsible for the upgrades, i.e. you need to decide when to upgrade and manage each upgrade project – including testing. A hosted solution is sometimes referred to as cloud-enabled or ASP.

"We were running one of the established hosted solutions, and certainly had some challenges. The software was very complex since it had grown over a long time, which made it difficult to onboard new team members and some portfolio managers even retreated back to spreadsheets in the end.

Change management was another challenge, we had to rely on external consultants to perform upgrade projects and implement new functionality. This resulted in a high total cost of ownership and slow delivery of enhancements, which in the end impaired our ability to provide the best return for our investors."

- CEO, $6bn Asset Manager

Car analogy: You lease the car and park it in a shared garage. You still pay for the garage, but you’ve got less maintenance to deal with both for the garage and the car. Downside is that you just have one car model for all your needs and it’s difficult/expensive to upgrade/change to another.

One-size-fits-all Software-as-a-Service (cloud-native)

Software-as-a-Service, sometimes also called cloud-native, moves the change management responsibility over to the vendor. I.e. the vendor is not only responsible for hosting the software but also for upgrading it – and conducting testing associated with that.

Software-as-a-Service is a great gift to asset managers globally because it relieves the distraction of upgrading and testing software, to allow more focus on alpha generating activities.

However, it did create some problems in the process:

- You can't control upgrade timing. For example, the system can change during volatile market conditions.

- You’re likely not able to configure / customise all your alpha generating workflows.

Therefore, we usually refer to this first generation of cloud-native solutions as “one-size-fits-all SaaS”.

Car analogy: You subscribe to a car-pool service, where a car shows up at your door when you need it. There is no maintenance at all for you. Downside is that there’s only one mainstream car model available, so if you’re ever in the need for a faster sports car or a larger family SUV, you may be disappointed.

Enterprise SaaS (cloud-native generation 2)

Enterprise Software-as-a-Service (SaaS) is a cloud-native system, engineered specifically to fit investment decision processes and operations workflows. The benefits of one-size-fits-all SaaS are immense, but the downsides – some mentioned above and more here - are material as well. Hence, “enterprise SaaS” was born to offer both the benefits of deployed, on-premises software as well as the pros of Software-as-a-Service. We’ll look at what this means in more detail in the next section.

"Our organisation is required to support some bespoke compliance rules, which we understood were not going to be available ‘out the box’. This was a key consideration in our choice of partner, and we worked closely with Limina and our business users to design appropriate solutions, which are now used on a daily basis, helping to streamline our processes and optimally manage our risk"

- Business Analyst, $11bn Asset Owner

Car analogy: You are still part of a car-pool service, but with flexibility to choose things that matter to you. For example, you can choose the brand and size of a car, so regardless of whether you want a faster sports car for the day or a bring your family on a trip in a larger SUV, you get what you need for a comfortable ride. There are some less important things you still can’t control, such as the colour of the car.

Custom, off-the-shelf and institutional SaaS

In the list below, we look at on-premises/hosted solutions compared to the first generation of cloud-native solutions (one-size-fits-all SaaS). We also contrast them both with the latest generation of investment management technology: enterprise SaaS. This table is a summary, and we’ll get into the details in subsequent sections of the guide as well as in breakout posts (linked throughout this guide).

Why isn’t everyone using SaaS portfolio management and order management software (yet)?

The first cloud-native order, portfolio and investment management solutions for buy-side firms were launched between 2000 and 2010. However, they serviced mostly smaller hedge funds. The reason these solutions – referred to here as “one-size-fits-all SaaS” - didn’t gain full traction within asset managers are:

- 01 Functional gaps

- 02 Limited customisation

- 03 Inflexible upgrades

- 04 Integration challenges

Gaps in functionality and/or asset class coverage

Some cloud-native systems were originally built for simple use cases, such as for start-up hedge funds. The system was designed, and data models were built, in a hard-coded fashion. Addition of new functionality is now difficult as it requires large changes to the foundation of the system.

Legacy vendors aren’t moving fast either. Reports indicate that upwards of 80% of technology budgets on the buy-side is spent on maintenance of legacy technology. This sadly means only 20% of the budget legacy vendors allocate to R&D goes to new functionality that is valuable for your business!

The way enterprise SaaS tackles these problems is with microservices. If future change to the system is the top priority, this is the optimal system architecture. It takes longer to initially get such an architecture to market, but once live it’s optimally prepared to be adapted to new requirements as fast and stable as possible.

Curious to see Limina's IMS in action? Schedule a no-strings-attached demo with us

Customisation and/or extensibility of alpha-generating workflows is limited in one-size-fits-all SaaS

A one-size-fits-all SaaS takes a path of high standardisation, which has yielded a lot of benefits such as faster implementations. The downside is that customisation and configuration of alpha-generating workflows and other activities that create value for you and your investors became limited.

Institutional portfolio management software sets out to balance the customisation approach by:

- Offering a higher level of customisation for workflows that are related to your unique workflows. These are likely to be related to generation of alpha or to delivering other value to your clients, such as real-time portfolio or compliance data.

- Standardising everything else.

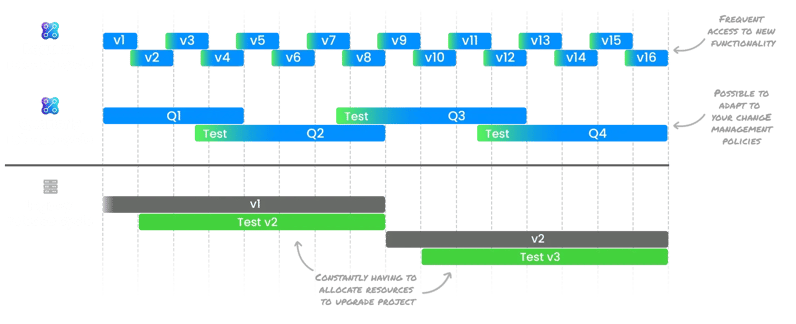

The enforced upgrade cycle of one-size-fits-all SaaS doesn’t fit you

The first-generation cloud-native solution providers decide, at their discretion, when to upgrade your system. This is usually a neat service, because the vendor is also responsible for regression testing, i.e. making sure nothing breaks in an upgrade.

More frequent upgrades = smaller changes which means a lower risk that something breaks.

However, there is a significant downside: the upgrade might happen at an ill-timed moment for you. Even if testing is the responsibility of the vendor, there is still a risk of regression issues in volatile market conditions.

Therefore, enterprise SaaS offers a set menu of different release cycles (read about why here). The vendor is still responsible for testing, but you can choose when the timing is right to upgrade.

Integration challenges aren’t solved by the cloud

According to a study we conducted recently, almost 90% of asset managers believe it’s important to have a better solution to integrations. That is a surprisingly high number, it means only 1 of out 10 asset managers are happy with the way their systems and integrations interoperate.

It’s often believed that cloud-native solutions magically integrate with other systems, especially other cloud systems, with no/little effort. This is (unfortunately) not the case.

It’s true that a cloud-native solution is more likely to have modern API capabilities, such as REST APIs. However, message formats are generally not standardised, which means two APIs don't fit like pieces of a puzzle and there is a need for a translator in between.

One-size-fits-all SaaS solutions give you access to the APIs, which is no different than the old way of giving you access to the database – integration problems are still up to you to solve.

The second way off-the-shelf SaaS solutions approach connectivity is for the vendor to manage integrations. This is also problematic because you are dependent on the vendor for integrations. In other words, if a new connection needs to be set up, you need to wait for your vendor to have capacity. And sometimes there is an increased cost as well.

Enterprise SaaS looks to finally relieve the pain of integrations by offering an integrated import and export engine. With such a tool you can:

- Connect sources of data

- Transform data (convert external data to your system’s format, and vice versa)

- Load data into the Investment Management System

The reverse is also possible – i.e. using the connectivity engine to extract data out of the Portfolio and Order Management System.

Limina’s CTO Andreas Fürst, discusses the problems with one-size-fits-all solutions for asset managers and how enterprise SaaS can address some of the challenges.

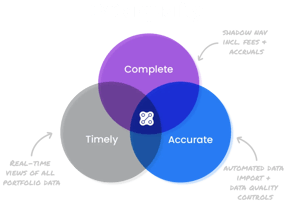

Data trust is a key concern

When surveying asset managers recently, we found that being able to better trust the portfolio data in the system was deemed a very high priority. More than half of respondents even ranked it as extremely important.

The top reasons for data quality lacking in front office and middle office system were identified by respondents in the 4 categories below.

Problems 1-3 are directly addressed by an enterprise approach to systems. We’ll discuss some functionality next that relates to overcoming these challenges. The guide will later also mention how 4 can be overcome, albeit unrelated to enterprise SaaS specifically.

Data is manually entered, and humans make mistakes. In other words: lack of automatic sanity checks for data entry.

Lack of integrated workflows, i.e. multiple systems used for investment operations and those systems aren’t in sync data wise.

Functionality of Institutional Order and Portfolio Management Software

In addition to the non-functional aspects of enterprise SaaS discussed above, there are also a few features offered by an institutional Investment Management System that usually are not present in off-the-shelf cloud solutions:

- 01 ETL tool

- 02 Configurable data controls

- 03 Approval workflows

- 04 Automation

Data import-export application

as briefly introduced above, a configurable import and export engine (or application) is a key component of an enterprise IMS. The key word here is configurable. I.e. it enables a business user (without technical expertise) to:

- Set up connections to new data sources

- Modify existing connections

- Instruct the application how to transform data: filter, sort, aggregate, identify positions/portfolios etc.

- Load the data into the Investment Book of Records / IMS

- Extract data out of the IMS / IBOR using the same tool

Configurable data quality controls

Configurable data quality controls continuously monitor the health of your data, based on the instructions you give it. Examples could be controlling for:

- Large price or P&L movements (you define what “large” means for your portfolios and your instruments)

- Instrument parameters, such as ESG rating required to be set on an instrument before it can be traded in your sustainability funds and/or mandates

- File not received as expected from custodian

X-eye approval workflows

4-eye approvals for orders and changes by operations to trades after confirmation are table stakes, supported by most solutions.

An enterprise SaaS takes oversight requirements further to include changes to compliance rules and parameter changes to instruments.

A concrete example is a change in a parameter on an FRN that affects estimated coupons and hence cash ladder. The change could be a manual update or a change from the market data provider. For such a change, you might want to have an approval workflow where there is not only an audit but a 4-eye approval before the parameter change takes effect.

Exception-based workflows

Operational load was the 3rd highest priority to decrease when we surveyed asset managers recently. 85% of asset managers said the following are key problems:

- Too much manual work, leading to mistakes and colleagues that don't thrive

- Difficult to scale operation teams efficiently and with quality

Exception-based workflows are an approach to automation for asset managers. It means most of the workflow is automated but leaving the key decision points for humans to act upon. As an example, the IMS can automatically identify a missing ESG parameter when trying to trade an existing instrument in a sustainability fund, and flags this for review, leaving it to humans to resolve them.

The point is that machines are exceptionally good at issue-identification, but humans are much better at issue-resolution. It’s our view that letting a machine completely be responsible for operational processes breaks good governance. However, a machine that provides oversight to empower humans makes the combination even stronger!

Enterprise Portfolio and Order Management SaaS

An enterprise solution isn’t perfect either and comes with some tradeoffs:

Compared to one-size-fits-all SaaS, the upfront investment might be higher for enterprise SaaS because the data quality checks must be configured.

The Total Cost of Ownership (TCO) is usually lower however, since enterprise SaaS will allow for more efficient and streamlined operations and investment processes.

An enterprise SaaS system is built to address integration challenges for asset managers. As discussed above, it doesn’t offer database access specifically.

In our opinion, APIs and configurable import/export provide the best alternative.

Learn more about Limina’s Enterprise SaaS solution

We hope that after reading this guide, it’s clear why we offer Institutional Investment Management software for the Front and Middle Office: to help you as a fellow investment manager to reap the benefits of the cloud while still:

- Having your data isolated

- Being able to customise your alpha-generating and value-adding processes, while still have minimum friction when upgrading the system

- Enjoying simple and transparent pricing and low Total Cost of Ownership

- Having fast time to market for new functionality and at the same time be in control of change management (not dependent on their vendor’s capacity)

- Empowering your teams’ decision support and oversight by having real-time access to high quality portfolio data

- Automating a large part of your processes through exception-based workflows

As former investment managers, we do acknowledge that a solution should never try to be everything for everyone. This is also the case with Limina’s Investment Management System. If you would like to explore when Limina might not be the best choice, you can dig into that here. Likewise, you can explore when we are likely to be a great fit here.

Topics not covered in this guide

Firstly, we didn't cover the difference between single- and multi-tenant solutions, which you can read about in a separate article here.

Another important area is end-to-end vs best-of-breed. These two are not mutually exclusive. As former investment managers, we believe that holistic workflows are important to achieve. For example, a portfolio manager shouldn’t have to jump between systems to complete a rebalancing sessions and route orders. With an integrated IMS at the core of your workflows, certain capabilities could reside in separate systems and still offer a smooth user experience.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - the team at Limina is happy to advise on any questions you may have about enterprise investment management software and how it can fit into your landscape and support your target operating model.