IBOR Standards Working Group Paper

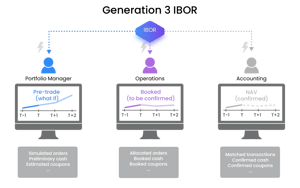

The Original IBOR Standards Working Group Paper, released in 2014, defines the modern Investment Book of Record (IBOR) requirements and definitions. The paper introduces the concept of "live extract" IBORs, also called generation-3 IBORs.

A Generation-3 IBOR dynamically generates positions upon request without reliance on stored snapshots, which create flexibility to include/exclude any transactions or cash movements of any state into the positions. The paper outlines the needs of users, focusing on enhancing data confidence across internal functions like the Front Office, to bolster investment decision-making and mitigate operational risk.

Explore Investment Book of Record further

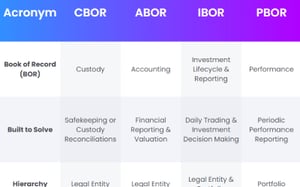

Discover why there are so many different BORs in Asset Management and the differences between IBOR, ABOR, PBOR and CBOR.

Read More

This article provides a comprehensive Investment Book of Record definition and unpacks the benefits and outline the three different types of IBORs.

Read More

Explore how IBOR technology has changed and evolved since the 2014 global standard was released and why there's only two real 3rd Generation IBOR solutions.

Read More

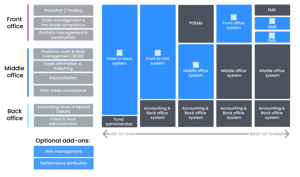

Understanding the difference between a front-to-back-office platform and an Investment Book of Record is crucial for asset managers to make the most informed investment decisions.

Read More

An Investment Book of Record can provide many benefits for an asset manager. We explore 5 business problem that a well-designed IBOR can solve, categorised in two areas.

Read More

Our article provides a comprehensive review of what the Investment Book of Record Global Standard is as well as detailing how the Limina IBOR compares.

Read More

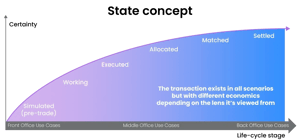

Find out how an IBOR considers all lifecycle stages of all transaction types when building position views for both front, middle and back-office use cases.

Read More

In this article, we consider the second key parameter of transactions (and positions): time. Specifically, how a live extract IBOR can achieve enhanced portfolio views.

Read More

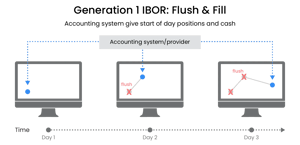

Are batch-based systems causing you headaches in the Front Office? We look at the challenges batch-based systems create for Asset Managers, particularly in the Front Office, and explore alternative approaches.

Read More

Discover the evolution of investment management's best-of-breed systems, weighing their benefits and limitations. Before exploring the emergence of integrated solutions and glimpsing into potential future developments.

Read More