CONNECTIVITY

Managed connectivity & managed integrations

When we say “managed”, we mean connectivity entirely handled by Limina as part of our Investment Management Platform. We set up the original connection and monitor it in production daily for you. We take care of any changes you might need to the integration.

This type of integration is very beneficial for you when multiple clients use the same connection in their environment. The cost is low compared to bespoke connections, and since many clients use them, they are inherently highly stable.

When is managed connectivity the right choice?

The primary objective of every integration is to increase operational efficiency. Managed connectivity serves to transfer any work and responsibility to the vendor. This approach is particularly advantageous for integrations shared by multiple clients, making them highly cost-effective for your organisation. Two scenarios where managed connectivity proves to be an excellent choice include integrations to trading venues / execution management systems as well as market data, as these are both highly standardised and complex to build/maintain, so this is better left to the vendor to manage.

Ultimately, the goal is to ensure your middle office operations and investment decision teams can get the data needed for compliance, portfolio monitoring and investment decisions – instead of spending time on administrative tasks or IT!

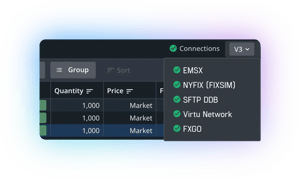

OMS integrations: FIX trading connections

Limina offers trading connections as managed connections directly from Limina’s Trade Order Management System (OMS). We work with counterparties to certify connections and ensure all supported trading cases work as expected. Examples of trading connections for routing orders include:

- Execution Management Systems (EMS)

- Outsourced trading providers

- Direct broker connectivity

Trade executions are typically communicated over the Financial Information eXchange (FIX) protocol when possible. Asset classes supported go beyond equity trading, covering fixed income, foreign exchange (FIX) and derivatives as well.

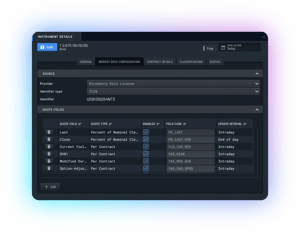

Market data connections

Limina has out-of-the-box connectivity to market data vendors, through which you can configure which data you want to download into your environment. Examples of data include:

- Terms & Conditions of instruments, e.g. day-count conventions and settlement offset

- Classifications on securities, e.g. voting rights, credit ratings and ESG data

- Snapshot quotes and analytics, e.g. prices, greeks, yield and duration

- Corporate actions and other instrument events, e.g. dividends or calls

You decide which market data subscription you want, and we connect to your source(s) of choice for snapshot and streaming market data.

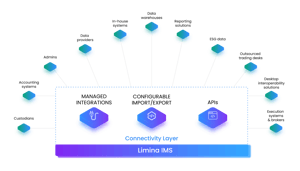

Alternatives to managed connectivity

There are six approaches to the integration of asset management systems and service providers. In summary, they include:

- Direct database access

- Vendor-managed connectivity (what this section is about)

- Custom file integrations

- APIs, e.g. REST or WebSockets

- Generic ETL-tool

- Purpose-built data import & export engine (domain-aware ETL tool)

Limina offers 2, 3, 4 and 6 – compared to most vendors who provide 2 and 3 (and sometimes 1 and 4). Read more by clicking the links above or reach out to us, and we’ll be more than happy to discuss the approach we take to connectivity and why we believe it’s the best approach for you.

Any integration with Limina aims to lower operational risk and make your team more efficient!

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.