Established vs Emerging Buy-Side Software Vendors: OMS & Technology Compared

As a relatively new investment management system provider, we’re often asked by prospective clients about the pros and cons of choosing Limina over an established buy-side OMS* vendor. In this post, we’ll cover specifically the reasons related to vendor size, i.e. the pros and cons of choosing a large vs small provider respectively.

* Order Management System (a subset of the functionality that an Investment Management System covers)

We discuss the pros and cons of choosing a new vs old vendor

Many aspects of a system selection process are unrelated to the size of the vendor. In this post, we only talk about the size-related considerations.

Is an emerging buy-side technology the best choice for your firm?

Benefits of choosing an emerging buy-side oms provider

An emerging buy-side software vendor is very likely to have the following benefits:

A cloud-native buy-side solution

Also called Software-as-a-Service (SaaS), if founded around 2005 or later. If founded around 2014 or later, they might have an Enterprise SaaS, which pairs the functionality required for running a large business with the ease of a cloud-based investment management platform.

A system build with the latest technology and architecture

This means the vendor will be able to deliver new functionality fast – now and in the future. However, technology decisions, such as building on microservices, usually mean a slower time to market at first. So, it’s not obvious that an emerging buy-side vendor is building the technology “right” from the start – we urge you to check this in your due diligence of a potential vendor.

A deep appreciation for each client

Since they have fewer clients, you are more likely to be given a lot of attention, i.e. you are likely to be a big fish in a small pond. Your input on product direction will be considered.

Note: Limina takes this further to a partnership approach

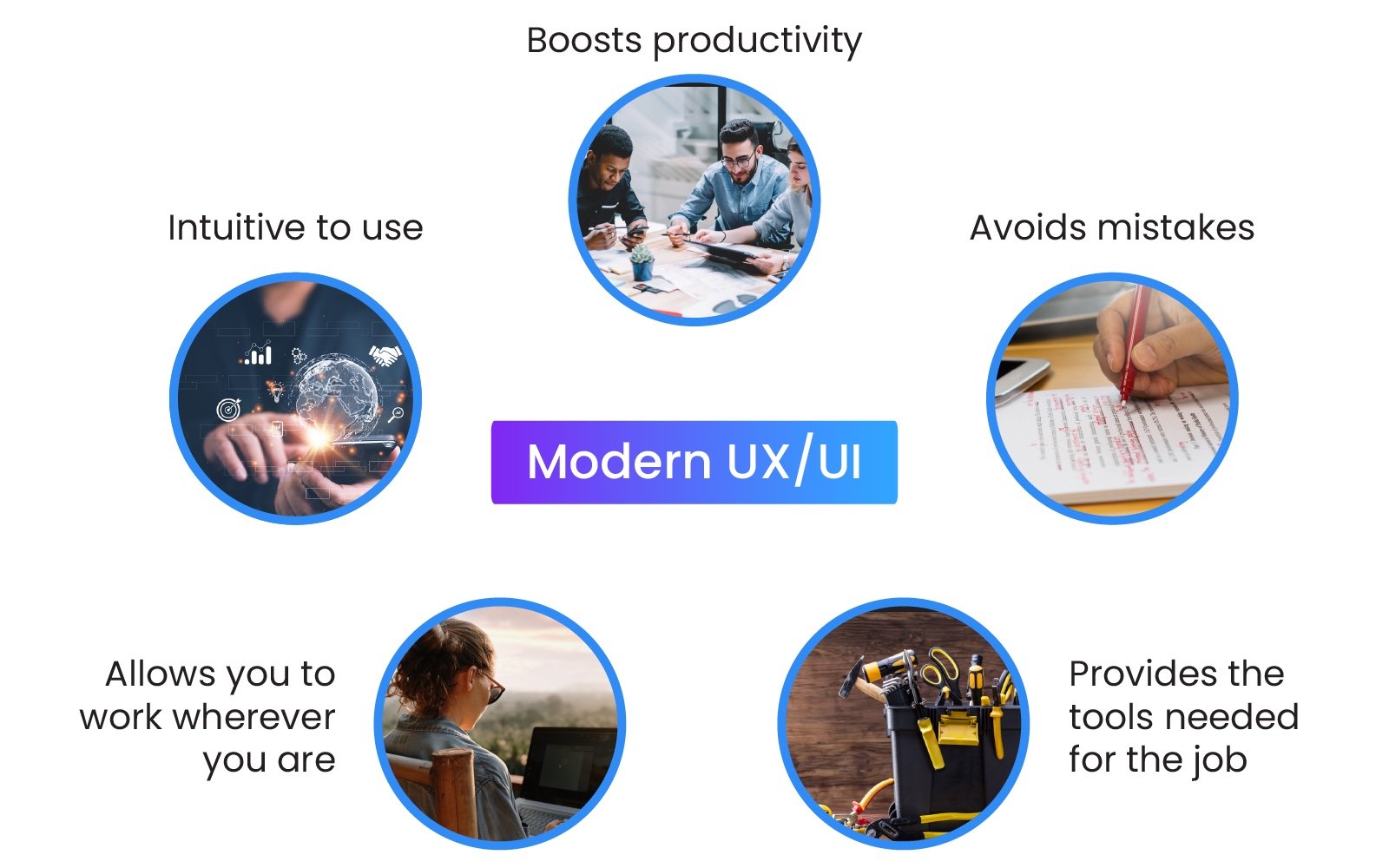

A modern user interface (UI) and user experience (UX)

Having a modern UX and UI for asset managers means it is intuitive to use and enables holistic end-to-end investment and operations workflows, as well as access from anywhere via mobile, browser and tablets.

What about the drawbacks?

An emerging OMS software vendor might:

- Be making a loss - to understand the size of this risk, we recommend digging into the cost structure of any vendor. For example, are they making a loss due to product development or due to sales expansion? The risk might be small or significant.

- Have functional gaps since they’ve had less time to build coverage - it's more important to check functional coverage in your procurement when you’re considering an emerging vendor.

- Have a limited support model - it’s not just about technology, but also how the product is implemented and supported. We recommend you investigate implementation and support staffing, regardless of the prospective vendor size.

Is an established/legacy buy-side software vendor suitable for your firm?

Benefits of choosing legacy buy-side technology

A legacy buy-side software vendor is likely to have the following benefits:

Functional coverage

After many years of development, the vendor is likely to have built a sophisticated set of features and functionality. However, they might still struggle to deliver next-generation capabilities, such as generation 3 IBOR.

Financial situation

With an established buy-side solution, there is peace of mind offered by their survival in the market and this is reassuring from a financial stability perspective.

Buy-side software that has been battle-tested for many years

Years in the market equates to a period of software being battle-tested, improved and optimised. Those still standing should be robust, which builds trust.

Many references and case studies

More testimonials, case studies and success stories can reassure you about the quality of the solution.

What about the drawbacks?

A legacy software vendor might:

- Not prioritise research and development (R&D) of their IBOR, portfolio or order management system - but rather reap financial rewards of technology investments made in previous decades.

- Have many clients and hence be unable to give you high attention - you’re likely to be a small fish in a big ocean, which means it’s less likely your wishes on product direction will be considered.

- Be less flexible - including fewer upgrades during the year, which can hold your firm back.

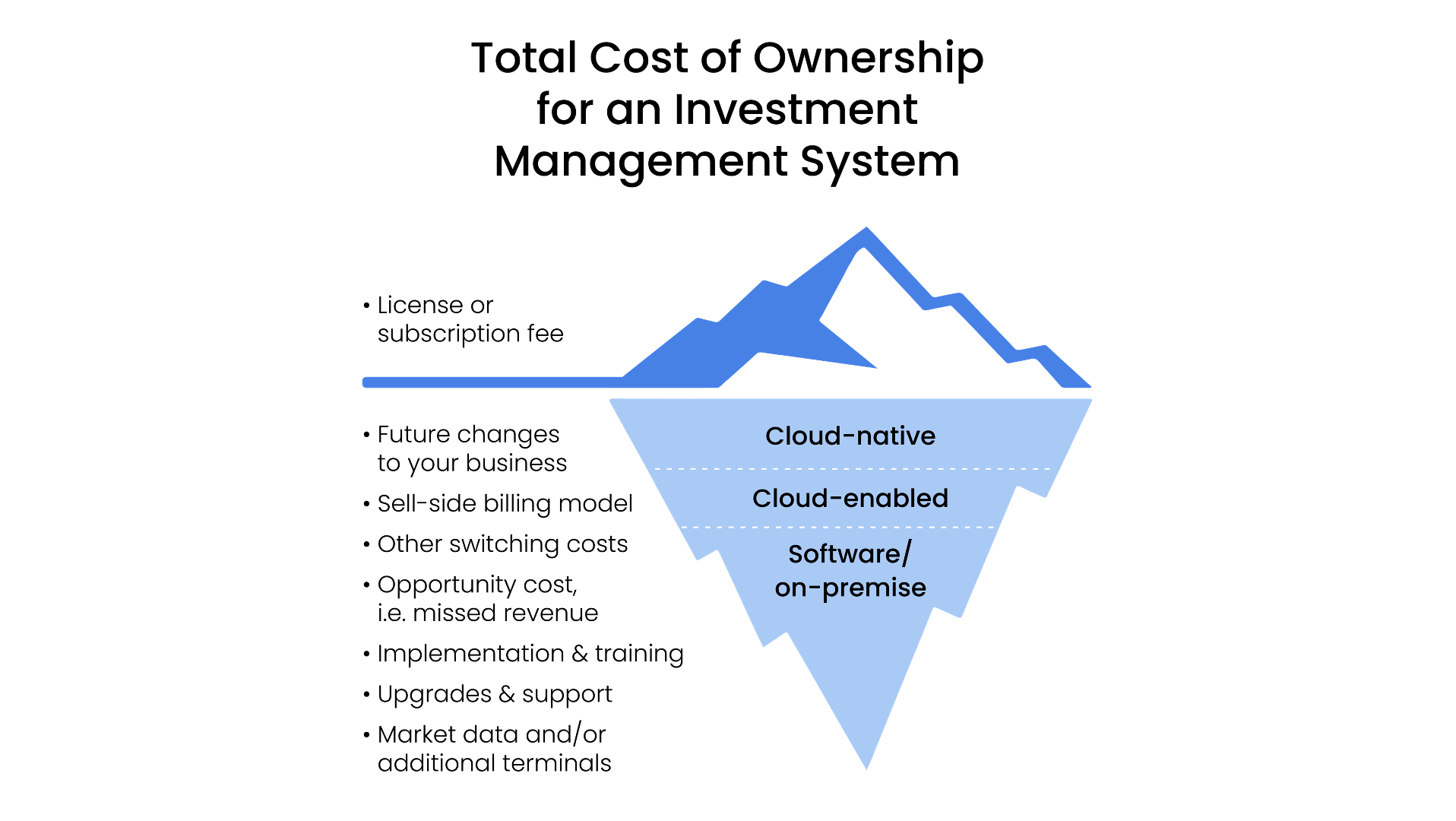

- Come with a higher total cost of ownership - partly due to older technology and architecture, which are resource-intensive. This might also imply slower changes to existing and updated functionality. Read about how Limina helps reduce costs here.

Additional advice when you’re comparing buy-side solution providers

We hope that this article has been useful in helping you to figure out the considerations to keep in mind when choosing between an emerging vs established vendor, for example when comparing top OMS providers.

As a general piece of advice, we recommend investigating the ownership structure and source of capital of any vendor. Is it coming from a long-term investor? Does the vendor have any conflict of interest or direct/indirect affiliation with other industry participants, such as being owned (partly or entirely) by a competitive firm?

If you have questions or would like to know more about when our investment portfolio management software will be a great fit for your company, read this article, or contact us to discover how Limina can help your firm achieve your goals.