Trade Order Management Software (OMS)

Choosing the best trade order management system is no easy task. Solutions are fit for different purposes, from single portfolio stock picking workflows to rebalancing hundreds of funds or mandates against model portfolios.

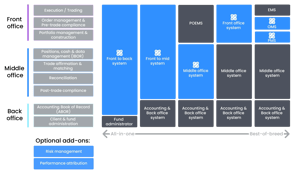

To complicate things further, an Order Management System for trading (OMS) can be standalone software or a component in a broader solution, such as a front, middle and back office solution.

For total transparency, Limina provides an OMS as one of the essential components in our investment manager software. To make it as fast and easy as possible for you to figure out whether to consider Limina as a solution, we have created two articles for you:

- what firms Limina is most suited for and

- when Limina might not be the right choice

Ensure you know the system architecture you want

An Order Management System (OMS) is just part of the full software capabilities an investment manager needs. This illustration summarises the other capabilities and highlights 5 different system architectures (operating models for investment managers).

An important consideration of an OMS is how positions and transactions are constructed. There are 2 primary ways, plus a hybrid variation:

- Flush and fill. This is the most common historically, where positions and cash are loaded every morning from an accounting source. Intraday trades are then added to the view. The downside is that the flush-and-fill approach doesn’t achieve completeness. It might miss future cash movements and cannot show a settle date cash ladder.

- Transaction-based, also called a live-extract Investment Book of Record (IBOR). This type of IBOR approach is new since 2014, and only two vendors in the market support the Global IBOR Standard (Limina is one).

- Hybrids, where for example positions are constructed but cash balances are imported.

The best order management system for trading

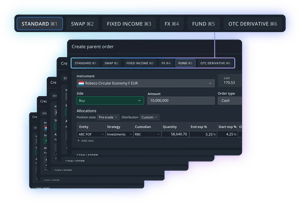

The best OMS is designed from the ground up as a cross-asset platform and does not suffer from old-school silos of asset classes. It provides coherent cross-asset workflows designed to provide an excellent user experience regardless of investment strategy.

For example, all workflows and screens are cross-asset but change dynamically to show the relevant information for each asset where applicable. This specifically reduces data clutter, ensuring your team’s foundation is validated information.

Trade quickly with complete control

- 1. DATA YOU CAN TRUST

- 2. EFFICIENT & USER FRIENDLY

Trusting the numbers and the software

Trusting the system starts with knowing that all investment data is correct as it flows to and from other systems. Our research shows that only 1 out of every 4 managers trust their portfolio data currently - independent of if other systems or Excel is being used.

Critical features to overcome investment data trust include:

- Front-Office needs the same live source of truth as the investment operations team (which also lowers your operational risk)

- Automatic data entry validation, warning for unusual input - where the definition of “unusual” is configurable

- Configurable broker restriction rules

- Complete audit trail from order raising to timestamps on each fill and allocations

- Four-eye approvals are available to turn on before routing orders

The Investment Compliance Software is continuously checking rules in the background, highlighting any breaches or when approaching a limit.

Fast and intuitive user interface

A modern user experience includes well-designed workflows for investment teams. An example is a minimal number of clicks to achieve a given action in the system. Limina's responsive user interface updates in real-time, with no batches or loading time.

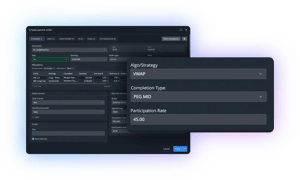

Configurable order parameter autofill saves time when raising orders. If you want to dig into order raising further, you can read more about Limina’s Portfolio tracking and modelling software.

The best OMS trading systems offer flexible yet intuitive solutions for complex workflows and processes. Efficient order workflows will help streamline and automate repeatable business tasks, minimising room for errors through in-depth data insights and increasing overall operational efficiency.

Also, having complete portfolio views and dashboards in your portfolio tracking software, where all data is consolidated, increases your oversight.

Wide range of order types supported

Limina's buy-side OMS for trading supports many order types, including the most standard, such as single-day orders. More complex order types include:

- Broker algos & handling instructions

- Block orders (multiple portfolios)

- Order programs (multiple securities)

- Multi-day trading (GTC orders), with daily allocations for the executed part of orders

- Primary market workflows, where bond parameters might not be known or not available from the market data vendor yet - see Limina’s EDM capabilities for more details

- Cash vs quantity-based orders, e.g. for fund trading

- Derivative strategy orders

Allocations and connectivity to matching & TCA

The Trade Order Management System has pre-built algorithms for allocations and supports manual allocations. Done for Day (DFD) processes are highly automated.

It integrates natively with industry-leading matching solutions and Transaction Cost Analysis (TCA) providers for post-trade execution reports.

Finally, charges such as commissions, platform fees etc. and SSIs auto-populated via rules.

Multi-asset OMS Trading platform

It's important to select a trade order management solution for multi-asset and multi-portfolio trading. Even if you're investing in a set of assets today, you never know what products you want to launch in the future. Preparing now for an unknown future, is usually wise.

Examples for assets supported by Limina include fixed-income such as bonds, equities (cash & swap), OTC derivatives, funds & FX. Read more about our asset class support here.

Managed OMS trading integrations for every asset class

Limina Order Management System for trading includes numerous managed integrations, enabling fully integrated workflows. Connectivity covers trade orders across different asset classes, and we fully manage integrations for you, ensuring they are always live.

The OMS Trading Platform is integrated and certified with various front office trading systems (so called Execution Management Systems, or EMS for short), such as for equities, derivatives, fixed-income, FX, fund trading platforms and more.

Limina offers direct broker connectivity to most established brokers globally (500+ brokers), enabled out of the box via NYFIX fix network, serving as a lightweight OEMS for trading. For fund trading, we have established integrations to select counterparties to trade funds electronically.

We also offer OTC derivatives workflows via file-based integrations in cases where it’s the only option provided by the counterparty.

See how Limina can help!

Want to see how Limina can help you save valuable time in your daily investment management workflows?