Investment data management

The breadth of information asset managers need to incorporate into investment workflows is ever-increasing. At the same time, ensuring quality hasn’t been widely solved by the financial services industry.

With Limina, we haven’t retrofitted Investment Data Management (IDM) capabilities on the side. Instead, it’s a core component of the Investment Management Platform, natively embedded into the various workflows. The integrated investment data capabilities bring a new level of oversight and governance where information is accessible and continuously quality-assured in an exception-based manner.

Data quality embedded into workflows

Strong data management capabilities embedded into your workflows is the best way to ensure you can make confident investment decisions.

Your firm’s investment decisions are only as good as the quality of the information those decisions are based on. There are operational risks associated with legacy approaches to data management.

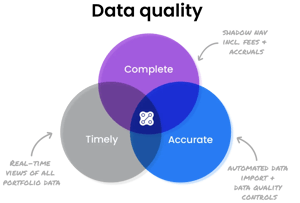

An investment data management solution aims to help you achieve complete, accurate and timely data. These concepts are all equally important but often overlooked by system vendors.

Example use cases of Limina's investment data management solution

- When setting up bespoke compliance rules leveraging external 3rd party data (ESG and risk classifications, analytics, etc.)

- When trading instruments not yet available at your market data provider, such as primary market workflows in fixed-income

- When overruling your market data provider in cases where their instrument fields might not be accurate (e.g. shares outstanding on specific small-cap or emerging market stocks)

- When enriching transactions with fields, fees, taxes etc, needed in downstream solutions, such as required for settlement instructions, TCA calculations or regulatory reporting

Complete portfolio data with extensible data models

Limina IMS is a transaction-based system, meaning there is no dependence on loading positions from an accounting source in the morning. The system tracks all non-trading related records and events (including fee accruals, cash transfers, and position lifecycle events), which ensures the system can represent your entire portfolios.

The data models in Limina IMS are extensible to allow for custom classifications on securities, legal entities, etc. You can extend the fields with, e.g. ESG data, risk classifications, market cap definitions and more. You can use these structured data points in your unique workflows, such as in compliance checks or as rebalancing parameters.

Security master data controls

Limina is designed to help you increase investment data trust. To achieve full trust in the numbers you see in the system, we embed traditional EDM functionality as part of a layer in the Investment management system.

For example, the IDM Solution has carefully designed Investment management data models. We developed the models to simplify setup and mapping with other systems while providing flexibility to enrich with custom data fields.

The security master in Limina IMS is market data vendor-agnostic, with out-of-the-box integrations fully managed by Limina. You can extend the security master with custom fields and validation rules to meet your firm’s need for required and optional fields.

Accurate portfolio data

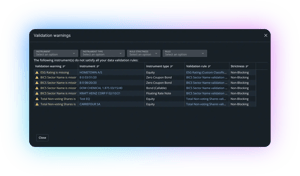

Custom validation rules and automated data quality control checks identify and flag issues early. We call that an exception-based workflow, where the system finds and notifies you about potential problems. Exception-based workflows ensure that your investment management operations team can work more efficiently and resolve any issues much earlier in the workflows. The system handles flagging of potential issues so that you can enjoy fewer manual checks. Essentially, exception-based workflows enable your team to focus on analysing and resolving issues.

Timely portfolio data

In time-critical situations, as in investment workflows, it doesn’t matter if the data is perfect - if it is not available when you need it. Needless to say, it’s difficult for Portfolio Managers to make informed decisions without up-to-date portfolio views. This holds true regardless of investment strategy.

Limina IMS is natively a real-time system with no silos between modules, which means that any change is readily available in real-time across the whole system, with no dependencies on batch processes. The real-time data extends well beyond prices, it includes cash and other events as well.

The key to increase investment process oversight:

Automated financial data management platform

Automation is historically challenging for asset managers. With built-in portfolio data management features, Limina IMS can help remove bottlenecks in investment processes and spot issues early on before they cause problems. This automation frees up valuable time for your team and enables you to manage risks.

All checks have full audit, enabling you to spot systematic issues and enhance processes.

Optional data validation steps

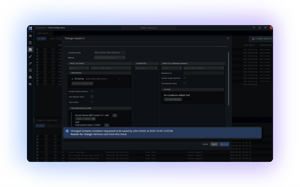

Governance is built into workflows, allowing for optional additional control steps (e.g., four-eye approval) when creating orders and approving transaction details ahead of affirmation/matching.

Limina takes 4-eye approvals one step further and allows for (configurable) approval processes on other data types as well. One example is in the pre and post trade compliance software, where you can configure a 4-eye approval requirement for compliance rule configuration changes. This duality check and staging of changes avoids issues. For example, a mistake in a compliance rule configuration could lead to orders being blocked incorrectly, or worse – permit orders that should have triggered a compliance breach.

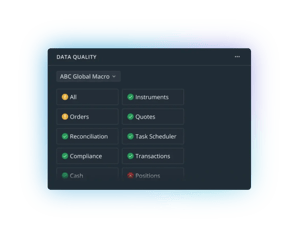

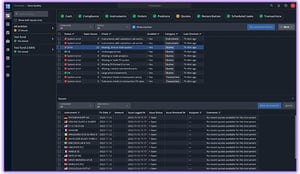

Automated data quality checks

Limina's Investment Data Management Solution includes automatic control checks for common issues, such as:

- Pricing issues

- Missing instrument setup

- Unprocessed orders

- Cash import delays

- Reconciliation breaks

These features allow your team to find and resolve issues early, freeing up valuable time and reducing the operational risks of manual checks.

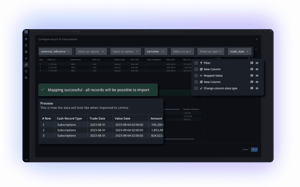

Get data in & out of the system smoothly

Without stable and efficient ways to get data in or out of the system, it inevitably gets outdated or even goes missing from the IMS. Limina offers managed connectivity (e.g. trading integrations and market data) and a configurable import and export (ETL) tool to overcome this.

CURIOUS TO LEARN MORE?

Don't hesitate to get in touch - we're happy to advise on any questions you may have about the product and how it can fit into your landscape and support your target operating model.